We having been writing a fair amount on the topic of asset allocation of late. In our Sunday linkfest we noted two pieces on asset allocation (Aleph Blog & Barron’s) that discuss the benefits of assessing investment risk in a multi-dimensional way. One conclusion from this sort of approach is a more active approach to asset allocation. While this does not imply “market timing” per se, it does mean a more hands-on approach to asset allocation.

What if this approach, and emphasis on risk, is all wrong? This approach would have been the right way to go about investing for the past decade as the stock market went sideways, albeit with big swings in each direction. One analyst sees a comeback for good old fashioned buy and hold investing.

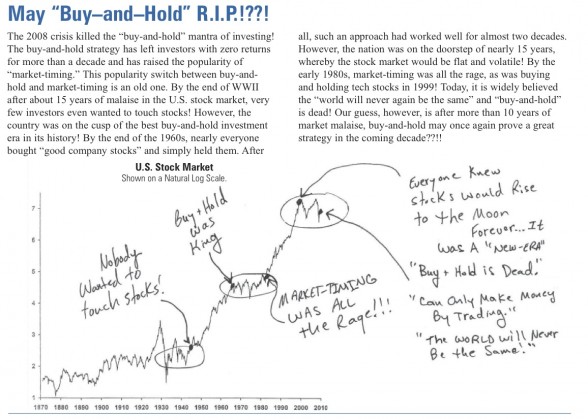

Justin Fox at the Curious Capitalist noted a piece by James Paulsen of Wells Capital Management. In it he discusses how the popularity of market timing waxes and wanes dependent upon the underlying market. The following excerpt is from Paulsen’s September 2009 Perspective piece and is included to show the graph below. One can see how market timing becomes popular at the inception of a bull market.

Source: Wells Capital Management

Paulsen goes on to make the case for an “earnings driven stock market” which would make a buy-and-hold sort of strategy attractive. Are we at that sort of turning point at the moment? Not sure that will necessarily be the case, but it is important to highlight contrasting opinions.

Update:

Leave it to David Merkel to have identified the possibility of a buy-and-hold making a comeback before any one else.