Quote of the day

Roger Lowenstein, “Excessive pay isn’t a problem just at banks; it’s endemic to the culture of corporate America.” (Bloomberg)

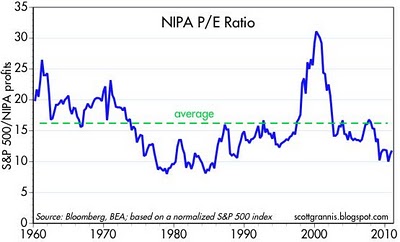

Chart of the day

Corporate profits continue rolling along. (Calafia Beach Pundit)

Markets

Reviewing sector performance of late. (Bespoke)

The straight line up that is silver. (SurlyTrader, Market Anthropology)

Why the price of oil isn’t going down much any time soon. (Credit Writedowns)

Be careful in analyzing the new individual stock VIXs. (Adam Warner)

Strategy

Beware the reversal of high yield bond inflows. (Distressed Debt Investing)

What now for the Permanent Portfolio? (Advisor Perspectives, Portfolioist)

Trading losses can also lead to a drawdown in emotional capital. (My Simple Quant)

Finance

The Libor inquiry is another example of the banks gone awry. (Points and Figures, FT Alphaville)

Breaking down the gold miner ETFs. (ETFdb)

Best Buy (BBY) has a hope for the future. (Jeff Matthews)

Global

Post-financial crises bank lending tends to bounce back quite slowly. (FT Alphaville)

On the perils of doing business in Russia, the case of BP (BP). (Money Game)

A central bank misery index. (The Source)

Economy

4Q GDP gets revised higher. (Calculated Risk, Capital Spectator)

A shift in trend? Has economic data taken a turn for the worse? (Free exchange, Money Game)

Another, more skeptical, look at the relationship between industrial production and commodities prices. (FT Alphaville)

Do we really want the Fed to hold quarterly news conferences? (NYTimes)

Earlier on Abnormal Returns

We talk the volatility risk premium with Jared Woodard on ARTV. (Abnormal Returns)

Market data geeks here is a post for you. (Abnormal Returns)

Our Friday morning live link look-in. (Abnormal Returns)

Mixed media

Social media and shareholder activism. (Dealbook)

Abnormal Returns is a founding member of the StockTwits Blog Network.