Quote of the day

Paul Amery, “It’s also debatable whether there ever was a golden age of plain vanilla ETFs, which were then superseded by all these nasty complex ones.” (FT Alphaville)

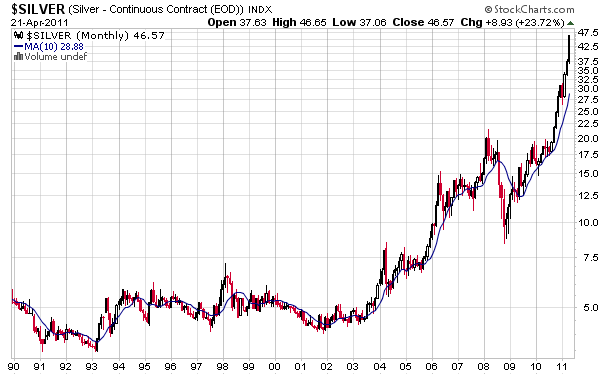

Chart of the day

How overextended is silver? (Expected Returns, Pragmatic Capitalism)

Markets

Contrarian indicator? Gold on the front page of the WSJ. (Big Picture)

An option for those who think they really need to short silver. (IndexUniverse also Bespoke)

Small cap stocks are all-time highs. What next? (chessNwine)

Retail investors really don’t like financials. (Trader’s Narrative)

More commodity ETNs coming to market. (ETFdb)

Strategy

David Merkel, “When everything is strong, be careful.” (Aleph Blog)

Price targets, especially for precious metals, are a fool’s errand. (The Reformed Broker)

How to buy uranium at a discount. (Marketwatch)

In praise of retail forex trading. (StockTwitsFX)

Companies

An Apple (AAPL) valuation matrix. (Global Macro Monitor)

No one really knows what Apple is going to do with its bulging cash hoard. (Dealbook)

McDonalds (MCD) is feeling costs pressures. (Reuters)

Chalk another one up for Warren Buffett and his merry band of sweetheart deals. (Deal Journal)

Finance

What are Wall Street analysts good for? (Pragmatic Capitalism)

Beware the high priests of muni finance. (NetNet)

Will a $30 million fine get the attention of energy traders? (Dealbreaker)

Fidelity proposes raising fees, apparently it doesn’t understand the world has changed. (Morningstar)

Global

How Canada is dealing with its budget deficit. (Real Time Economics)

Economy

Rail traffic remains on track. (ValuePlays)

Earlier on Abnormal Returns

ARTV on actively managed ETFs. (Abnormal Returns)

Mixed media

More financial iPad app reviews. (VIX and More)

Abnormal Returns is a founding member of the StockTwits Blog Network.