Quote of the day

“Finance seems to be a polytheistic rather than a monotheistic faith.” (Economist)

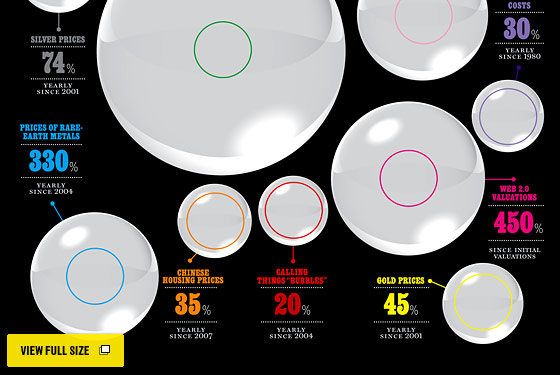

Chart of the day

Comparing the recent spate of bubbles, including the bubble in calling things bubbles. (NYMag)

Markets

Equity sentiment at week-end. (Trader’s Narrative, The Technical Take)

Weakening sector breadth is not helping the investment picture. (A Dash of Insight)

A look at some global trend indicators. (Global Macro Monitor, ibid)

What would Einstein make of bonds? (Tim Harford)

Strategy

The case for “cheap, megacap equities.” (Bronte Capital, Castellano, TRB)

Global macro can imply a whole range of strategies. (FT)

On the importance of taking a broader view of your trading risk. (TechInsidr)

On the parallels between active investing and gambling. (I Heart Wall Street)

What the types of companies issuing (and repurchasing) stock tell us about future returns. (Journal of Finance)

Finance

More banks does not make for a better IPO. (WSJ)

An interesting first hand look back at another hot IPO, TheStreet.com. (WSJ)

Is there a social media bubble and if so what greater economic effect might it have? (Becker-Posner)

Global

Europe’s political leaders are rapidly falling behind the curve. (Pragmatic Capitalism also Stock Sage, Big Picture, FT)

Germany is going to eliminate nuclear power from its energy portfolio. (WSJ)

Economy

Looks like we are getting a dip in growth, similar to last year’s. (Gavyn Davies)

This week’s economic schedule. (Calculated Risk)

A couple of observations about the state of the housing economy. (Calculated Risk, ibid)

Sports

Talk about not counting your chickens… (ESPN)

Ranking baseball’s best parks. (FiveThirtyEight)

Abnormal Returns is a founding member of the StockTwits Blog Network.