Quote of the day

Brett Steenbarger, “For me, trading is all about mastery: the mastery of markets’ complexities and the myriad challenges of self-mastery. ” (SMB Training)

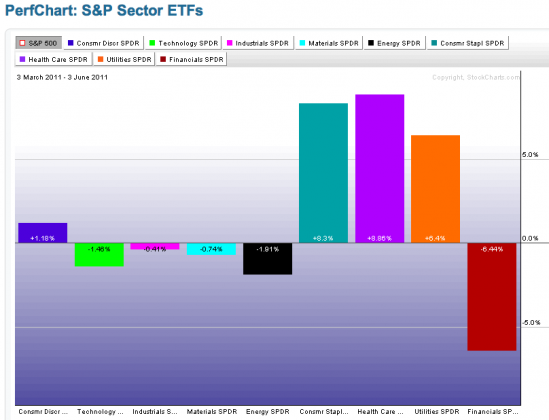

Chart of the day

The shift towards defensive stocks illustrated. (MarketBeat)

Markets

All major equity indices are below their 50-day moving averages. (Global Macro Monitor)

Retailers have started to weaken. (StockCharts Blog)

June has historically been a punk month for the stock market. (The Reformed Broker)

A recession brings to prominence the end-of-the-world investment crowd. (Washington Post also Barron’s)

Strategy

How to make your performance stand out – use a misleading index for comparison. (WSJ)

Adding momentum to a REIT strategy. (Aleph Blog)

A great trading paradox: we trade too much and feel guilty about it. (NYTimes)

Nathan Hale, “The fact of the matter is that good, basic investment advice doesn’t need to be customized to any large extent” (CBS Moneywatch)

The annuity puzzle: why people view it more as a gamble than insurance. (NYTimes)

Technology

Apple (AAPL) is now worth than Microsoft (MSFT) and Intel (INTC) combined. (Daring Fireball)

Does Amazon (AMZN) need a tablet to compete with Apple (AAPL) and Google (GOOG)? (MarketBeat)

It is hard to put the Groupon puzzle together. (Barron’s, Felix Salmon, SAI, kottke)

Zynga is likely coming to market soon. (CNNMoney)

Finance

What is going to be the “next big thing” for banks? (Macro Man)

John Paulson likely lost a bundle on Sino-Forest. (Term Sheet, Felix Salmon, Can Turtles Fly?)

Economy

What 2% economic growth implies a lot of changes in American society. (Time also Economix)

The Fed is in a bit of a box. (Real Time Economics)

It is hard to escape the idea of a global manufacturing slowdown. (NYTimes)

When will Americans start re-entering the workforce? (Atlantic Business)

Gregor Macdonald, ‘While it’s a positive that the US is reducing its demand for oil, it doesn’t necessarily mean we are becoming more efficient.” (Gregor.us)

An interesting look at the long term reduction in price of natural gas relative to oil. (Calafia Beach Pundit)

Earlier on Abnormal Returns

What you missed in our Saturday longreads linkfest. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Abnormal Returns is a founding member of the StockTwits Blog Network.