Quote of the day

Cullen Roche, “The market is not the economy. And it is not the efficient pricing mechanism we have all come to believe it is.” (Pragmatic Capitalism)

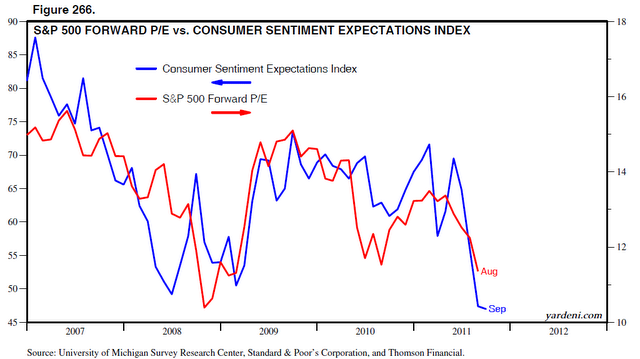

Chart of the day

Consumer sentiment and market valuations. (Dr. Ed’s Blog also allETF)

Markets

The stock market and ECRI WLI have parted ways. (MarketBeat)

Eric Sprott keeps on selling shares in $PSLV. (Kid Dynamite)

A look back at your opportunities to get into Apple. (Afraid to Trade)

Muni bond investors are taking on more risk. (Focus on Funds)

Strategy

In the Age of the Algorithm due diligence is even more important. (the research puzzle)

How has a seasonality system been doing of late. (MarketSci Blog)

Monthly drawdowns stats can cover up higher intra-month volatility. (HedgeWorld)

The real goal of forecasting. (Systematic Relative Strength)

Companies

It is still hard to see how Apple ($AAPL) is overvalued. (Crossing Wall Street)

Chipotle Mexican Grill ($CMG): great company, expensive stock. (Frank Voisin)

Companies have been adding cash to the balance sheet for decades. (Planet Money)

ETFs

The European ETF model is looking shaky. (FT Alphaville)

Have gold ETFs “cannibalized” demand for gold equities? (FT)

What’s in your China ETF? (IndexUniverse)

Finance

Warren Buffett’s new money managers are going to take a pay cut. (Dealbook)

Why we need fifty more bank regulators not one more powerful one. (Aleph Blog)

Of course the S&P USA downgrade news was leaked. (Dynamic Hedge)

Apple is still too expensive to add to the Dow. (MarketBeat, Bespoke)

Global

Burton Malkiel is hot for emerging markets. (FT)

Why Italy matters. (Global Macro Monitor)

The debate about Peak Oil is a red herring. (Econbrowser)

Forget oil, coal has already made a big comeback. (Gregor Macdonald)

Economy

Why are we still talking about the 70s style inflation? (Economist’s View)

Americans are remodeling their homes at a fast clip. (Calculated Risk)

On the challenge of avoiding a second lost decade. (Econbrowser)

Operation Twist would not do much for the economy. (Calafia Beach Pundit, SurlyTrader)

The Fed does not have many good options at the moment. (Gavyn Davies)

Only advanced degree holders saw a jump in income over the past decade. (Real Time Economics)

Earlier on Abnormal Returns

The real failure at Netflix ($NFLX). (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Technology down on the farm. (Points and Figures)

We need a better electrical grid. (Scientific American)

Hard to believe but online poker now looks even worse in retrospect. (WSJ)

Abnormal Returns is a founding member of the StockTwits Blog Network.