Quote of the day

DWMM, “Good investing is an uphill run against human nature. ” (Systematic Relative Strength)

Chart of the day

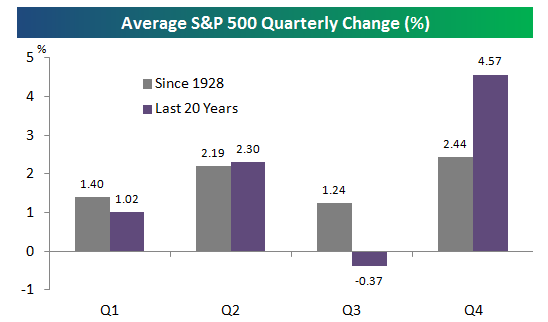

Come on Q4! (Bespoke)

Markets

Putting Sucktember in the books. (The Reformed Broker)

If the commodity trade is over, what does it mean for equities? (Market Anthropology)

On the real risk to the muni bond market. (Bond Girl also FT Alphaville)

Why Meredith Whitney’s call for munipocalypse a year ago caused such damage. (MuniLand)

How has gold done historically in October? (MarketSci Blog)

Strategy

The Ultimate Risk Index is firmly negative. (macrofugue)

Why higher dividend yields may be here to stay. (Mark Hulbert)

Dear dividend investors, dividends can decline. (Invest With An Edge)

Portfolio rebalancing: risk control or return enhancing? (ETF Replay)

Companies

Outsized severance packages, cough Hewlett-Packard ($HPQ), are still common place. (NYTimes)

The 10 things Apple ($AAPL) needs to do in response to the Kindle Fire. (SplatF)

Amazon ($AMZN) has mastered the market share game. (Phil Pearlman)

In praise of the new Windows Phone. (Slate)

A quarter century of Coca-Cola ($KO) returns. (research puzzle pix)

ETFs

What new ETFs do you want to see? (World Beta)

John Bogle on the “social value” of ETFs. (IndexUniverse)

Finance

All eyes are on Morgan Stanley ($MS). (Bloomberg, FT Alphaville)

What is going on at Discover Financial Services ($DFS)? (Bronte Capital)

Distressed debt investors are hunting for opportunities in Europe. (Distressed Debt Investing)

In praise of higher bank fees. (Daniel Gross, Clusterstock)

Play chess? Wall Street may want you. (Dealbook)

Global

Ireland is making progress. (WSJ)

Three steps to save Europe. (Pragmatic Capitalism)

Is a ‘hard landing’ in China a sure thing? (Crackerjack Finance)

The big correction in Chinese real estate is finally here. (FT)

A look at China CDS prices. (FT Alphaville)

Emerging economies are stuck betwixt and between. (Money Game)

Economy

The Chicago PMI came in ahead of expectations. (Calculated Risk, Real Time Economics)

Speculation on the effects of Operation Twist. (WSJ, Bloomberg)

The downside of ZIRP. (Global Macro Monitor)

In search of a double-dip recession in the yield curve. (Calafia Beach Pundit)

Earlier on Abnormal Returns

If we are already in a recession a review of what it means for earnings and the stock market. (Abnormal Returns)

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

The US is still number one in research universities. (Economix)

What Twitter tells us about our collective moods. (NYTimes)

Using social media to predict box office returns. (Speakeasy)

Abnormal Returns is a founding member of the StockTwits Blog Network.