Quote of the day

Robert Sinn, “The market doesn’t have to do anything.” (Stock Sage)

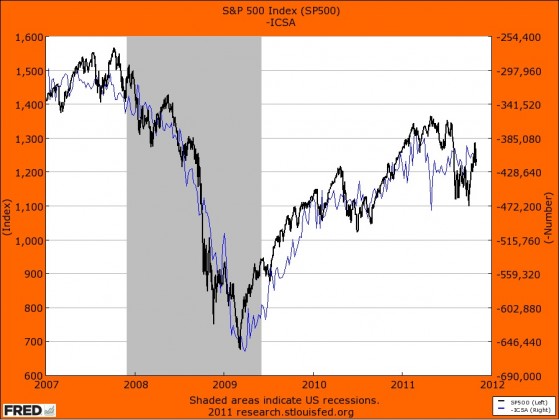

Chart of the day

What the stock market really cares about. (Money Game)

Markets

Keep an eye on the financials as a market tell. (Market Anthropology)

A look at the $VIX futures curve. (VIX and More)

It’s Groundhog Day for the markets. (Pragmatic Capitalism)

Strategy

On the differences (and similarities) between trading and investing. (Above the Market)

You have to find a way to deal with the stresses of trading. (Attitrade)

Four traits of the perfect trader. (SMB Training)

The quant stock screening bible. (World Beta)

Technology

Why you shouldn’t hold Groupon ($GRPN) shares over the long run. (SAI)

Hard to tell how much Groupon is worth until they put more shares in public hands. (The Reformed Broker)

There is no social media bubble. (Slate contra GigaOM)

What media services do Americans pay for? (SplatF)

Is there a future for “phone-only” handset makers? (Asymco)

Finance

How much does a 3 b.p. transaction tax add up to? (FT Alphaville also Buttonwood, Term Sheet)

Bank of America ($BAC) is getting the best of both worlds in this deal. (Kid Dynamite, Dealbreaker)

Why the MF Global bankruptcy matters. (Minyanville)

The secondary bank loan market is busy. (Term Sheet)

On the true value of a Nobel Prize. (Felix Salmon)

Funds

The newly formed S&P/Dow Jones Indexes is now a reality. (IndexUniverse)

Hedge funds lagged the equity markets in October. (Institutional Investor)

Don’t forget that ETNS are not ETFs. (HistorySquared)

Global

What central banks in frontier markets are doing. (FT)

Where did all the emerging market IPOs go? (beyondbrics)

The European sovereign debt crisis as one big form of vendor financing. (Credit Writedowns)

Making the case for Greek equities. (Marketwatch)

Economy

The October non-farm payrolls number was another mixed bag. (Calculated Risk, ibid, Real Time Economics, CBP)

The ECRI WLI ticked up again. (MarketBeat)

Are there no projects worth funding with negative real yields? (Economist’s View)

The true cost of losing your job in the Great Recession. (The Atlantic)

Earlier on Abnormal Returns

Happy third blogiversary Josh! (Abnormal Returns)

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty![]() by Esther Duflo and Abhijit Banerjee won the 2011 FT Goldman Sachs Business Book of the Year.* (FT)

by Esther Duflo and Abhijit Banerjee won the 2011 FT Goldman Sachs Business Book of the Year.* (FT)

Why science majors change their mind. (NYTimes)

How our sense of fairness affects our reaction to inequality. (The Frontal Cortex)

Abnormal Returns is a founding member of the StockTwits Blog Network.

*Amazon affiliate. You know the drill.