Quote of the day

Why do universities have endowments? Tyler Cowen, “Because they can.” (Marginal Revolution)

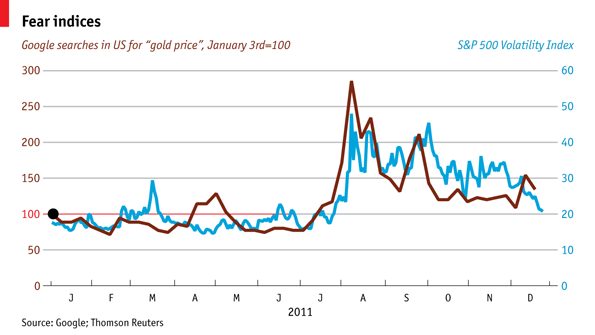

Chart of the day

The correlation between the $VIX and Google searches for gold. (Economist via Clusterstock)

Markets

Is the Treasury bull market over? (Crossing Wall Street)

The “depressing” list of top S&P 500 stocks for 2011. (Slate)

January seasonal tendencies. (Pragmatic Capitalism)

Strategy

You can’t create a new trading algorithm without a little “play, courage and guesswork.” (Bigger Capital)

How to set (and adjust) stop loss orders. (Dragonfly Capital)

In search of the origins of low volatility investing. (Falkenblog)

Companies

If 2012 is the year of a housing comeback, home remodeling stocks could outperform. (The Reformed Broker, MarketBeat)

The case for Dreamworks Animation ($DWA) as being undervalued. (Whopper Investments via @geoffgannon)

Reason to worry about Amazon.com ($AMZN). (Deal Journal)

Companies plan to buy more tablets in 2012. (Apple 2.0, GigaOM)

Finance

The shadow banking system is as big as it has ever been. (FT)

US banks continue to stockpile Agency MBS. (Economic Musings)

Corporate bonds are the new sovereigns. (Breakingviews)

The top dealmakers in 2011. (Dealbook)

Funds

The hedge fund equation simply doesn’t work for investors. (MarketBeat)

Don’t think you can understand a manager’s process just by examining his returns. (the research puzzle)

The problem with buying “hot funds.” (Aleph Blog)

The Sequoia Fund has the kind of portfolio Warren Buffett would have if he ran a mutual fund. (Bloomberg)

Not your typical ETF closure. (Invest With An Edge)

Economy

A tick up in weekly unemployment claims. (Calculated Risk)

Where you think the unemployment rate is going is dependent on a changing labor participation rate. (Liberty Street Economics)

How pension plans and Social Security differ on their effect on the economy. (Felix Salmon)

Is the era of subsidized corn ethanol finally over? (Big Picture)

Why have blogs “enriched the debate” in economics but not in other fields? (Economist)

Earlier on Abnormal Returns

The top clicks in 2011 on Abnormal Returns. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

As social media grows a need to filter becomes all the more important. (Economist)

Advice on how to be a landlord. (Megan McArdle)

Abnormal Returns is a founding member of the StockTwits Blog Network.