Quote of the day

David Merkel, “Financial intermediation leaves money on the table. It does not seek the best investment outcome, but takes a lesser return, so that goals can be achieved with greater certainty.” (Aleph Blog)

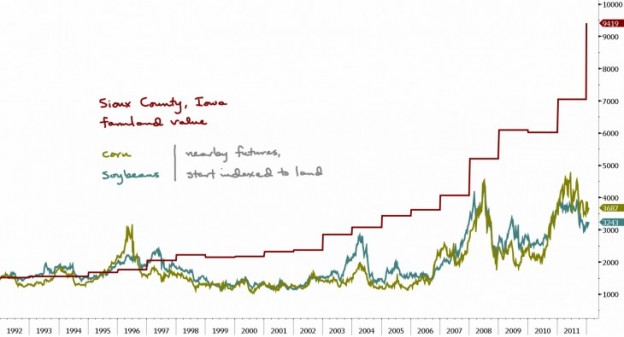

Chart of the day

The farmland boom: the Sioux County, Iowa edition. (research puzzle pix)

Markets

On the slowing growth in earnings. (MarketBeat, Crossing Wall Street)

The story of two risk indexes. (Sober Look)

Why daytraders shouldn’t ignore overnight gaps. (Adam Grimes)

Bonds

There is room for muni bonds to correct in here. (Dragonfly Capital)

Using historical bond returns to measure market conditions. (Dynamic Hedge)

Bonds still represent a diversification opportunity. (Morningstar)

Strategy

Thinking about how dividend policies affect ROE. (Frank Voisin)

These companies, largely MLPs, continue to increase their dividends on a quarterly basis. (Dynamic Dividend)

Investors are likely overpaying for safety these days. (Morningstar)

Research

On the importance of systematic risk for hedge fund returns. (SSRN via CXOAG)

High short interest? Sell the bonds. (Alea)

Internet

Tracking the price of Internet domain names. (FT Alphaville)

Google ($GOOG) knows you are and its going to tell the world. (WSJ also Modeled Behavior)

Finance

The futures industry escaped the financial crisis only to be brought low by the collapse of MF Global. (Dealbook)

Social media for finance goes pro with the new, albeit beta, StockTwits Pro. (Howard Lindzon)

The first seven ETFs of 2012. (Invest With An Edge)

Global

The UK economy contracted in the last quarter of 2011. (FT)

What happens if Greece can’t come to an agreement with bondholders? (Felix Salmon)

The situation is Europe is still untenable. (Credit Writedowns)

A nice visualization of the slowdown in global economic growth pre- and post-crisis. (Global Macro Monitor also Real Time Economics)

Economy

The Fed now sees exceptionally low rates through 2014. (Calculated Risk, MarketBeat)

Another indicator showing slowing inflation. (Carpe Diem)

Why Silicon Valley seems to be an economy unto itself. (Free exchange)

Earlier on Abnormal Returns

Nobody knows nothing: Apple ($AAPL) earnings edition. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Brown fat is kind of like dark matter. We know it exists, but is still a mystery. (NYTimes)

Unclutter your working space to focus better. (Farnam Street)

Abnormal Returns is a founding member of the StockTwits Blog Network.