Quote of the day

Doug Kass, “But quite frankly, the streets of Wall Street are paved with geniuses who have made one great call in a row.” (TheStreet)

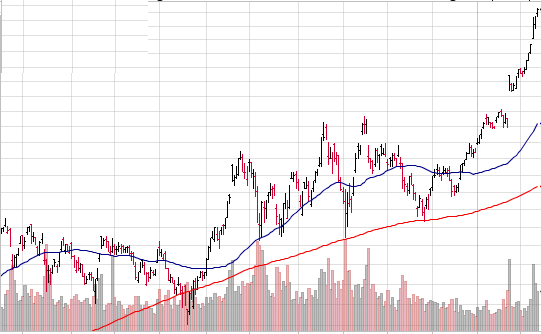

Chart of the day

Would you buy this stock? (Pragmatic Capitalism)

Markets

If earnings slow, focus on big cap, quality names. (Big Picture)

Why equity investors should pay attention to the high yield bond market. (The Reformed Broker, Sober Look)

If gold is so volatile, why is it considered a safe haven? (Free exchange)

The Sports Illustrated cover model indicator is positive for the USA. (Money Game, Bespoke)

Strategy

The case for larger frontier market allocations. (SSRN via CXOAG)

On the information advantages of hedge funds. (The Psy-Fi Blog)

The recency bias: just because something hasn’t happened recently doesn’t mean it won’t. (Bucks Blog)

Companies

The silliness that is Broadvision ($BVSN). (research puzzle pix)

The chemical industry is back thanks in large part to low natural gas prices. (NPR)

Green Mountain Coffee ($GMCR) has a patent (expiration) problem. (YCharts Blog)

Social curation has gone wide, maybe too wide. (GigaOM)

Agriculture

US farmers are set to plant the most corn since WW2. (FT)

McDonald’s ($MCD) decision is set to transform the pork industry. (Chicago Tribune)

Are ancient farmer’s to blame for climate change? (Scientific American)

Apple

Apple stock has a big impact on headline equity indices. (Mark Hulbert)

Should we worried about the parabolic rise in Apple? (Market Anthropology, Minyanville)

ARM Holdings ($ARMH) vs. Intel ($INTC): the battle for Apple ($AAPL). (Cult of Mac via Daring Fireball)

Apple isn’t exactly earning big returns on its huge cash hoard. (Reuters also Deal Journal)

Rumors abound that Apple is testing smaller iPads. (WSJ, GigaOM, Apple 2.0)

Finance

Where are all the IPOs and secondaries? (Capital Observer)

How Facebook’s small proposed float reflects private market dynamics. (Felix Salmon)

Corporate bond markets are getting ever thinner. (Sober Look, Dealbreaker)

The future of Citigroup ($C) is overseas. (Fortune)

Reforming money market funds: an abundantly co-authored paper. (SSRN)

One big investor thinks it is time for carried interest to be taxed as ordinary income. (Term Sheet)

ETFs

Choosing a high dividend ETF. (IndexUniverse also ETF Trends)

Blackrock ($BLK) is on tear when it comes to launching new ETFs in 2012. (Invest With An Edge)

Global

The price of austerity: the case of Greece. (Pragmatic Capitalism)

Does Germany want Greece to default? (NetNet)

Japan wants a weaker Yen. (MarketBeat)

Economy

Retail sales for December were pretty much in line. (Calculated Risk, Money Game, Capital Spectator)

A look at the transportation economy. (Dr. Ed’s Blog also Calculated Risk)

Richard Thaler on using lotteries for good, not evil. (NYTimes)

Earlier on Abnormal Returns

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Financial literacy is ‘pretty dismal.’ (Economix)

Things are getting ugly (and personal) in the tech blogosophere. (Atlantic Wire)

Part two of talk with Yves Smith of naked capitalism fame. (FT Alphaville)

Abnormal Returns is a founding member of the StockTwits Blog Network.