Quote of the day

Scott D. Anthony author of The Little Black Book of Innovation, “If you want to innovate, it is always good to start with a degree of humility. ” (Globe and Mail)

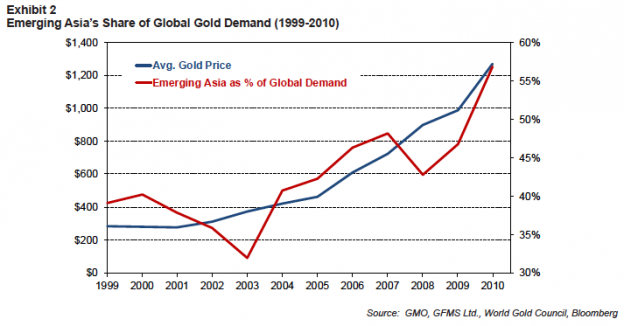

Chart of the day

Emerging Asia hearts gold. (Gregor Macdonald)

Markets

The market is NOT closed for President’s Day. (bclund)

You have been warned: financial advisors love big cap, dividend payers. (Money Game)

High dividend stocks should outperform as long as the Fed remains in easy money mode. (Sober Look)

Why aren’t the industrial metals rallying? (Bonddad Blog)

Strategy

What does ‘passive investing‘ really mean? (Portfolio Probe)

The many ways in which overconfidence affect investors. (SSRN via CXOAG)

Companies

Pfizer ($PFE) is contemplating a carve out of its animal health business. (FT)

Can Yum Brands ($YUM) finally turn Taco Bell around? (The Reformed Broker, Money Game)

All of General Mills ($GIS) outperformance comes during recessions. (research puzzle pix)

Finance

ETFs

The VelocityShares Daily 2X VIX Short-Term ETN ($TVIX) is the new darling of $VIX traders. (VIX and More)

Dear Eric Sprott, Reg FD is a real thing. (Kid Dynamite)

Global

Trade Greek stocks at your own risk. (FT Alphaville)

Emerging market bond investors cannot live on credit ratings alone. (beyondbrics)

Iran may have a hard time finding buyers for its oil, post-sanctions. (FT, NYTimes also TRB)

Japan has a trade deficit problem. (Sober Look, FT)

Economy

Is it time to start worrying about inflation? (Time)

$4 gasoline is going to pinch consumers. (Horan Capital)

Closing the gap: alternative to the Keystone pipeline project. (Econbrowser)

The real crisis of capitalism is unemployment, especially youth unemployment. (Pension Pulse)

The week in review/preview

On falling risk and the prospects of a housing recovery. (A Dash of Insight)

Where markets stand at week-end. (Global Macro Monitor, ibid)

The economic week in review. (Bonddad Blog)

The economic schedule for the coming week. (Calculated Risk)

Mixed media

The world is shrinking. (Howard Lindzon, Seth Godin)

Some tips on not pissing your fortune away. (Business Insider)

Moneyball comes to ticket pricing. (Crain’s Chicago)

Abnormal Returns is a founding member of the StockTwits Blog Network.