Quote of the day

Eli Radke, “Be careful how you filter information as you may start to eventually believe it.” (Trader Habits)

Chart of the day

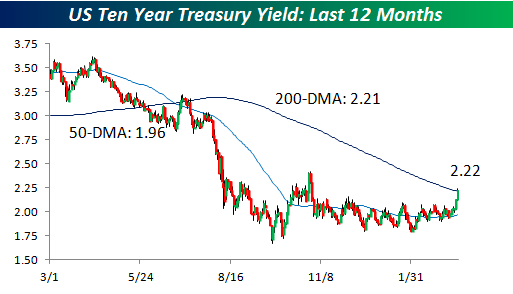

The yield on the ten year Treasury note just busted through the 200 day moving average. (Bespoke)

Markets

Yesterday was a 90% breadth day. What happens next? (Quantifiable Edges)

A market conundrum: inconsistent risk appetites. (SurlyTrader)

What if the stock market were a bond? (Crossing Wall Street)

Avoid low volume rallies at your own risk. (Bespoke)

The VIX

A 15 handle on the VIX is not all that anomalous historically. (Bespoke)

Just in case you forgot the VIX futures curve is wicked steep. (VIX and More)

Seriously, a VIX for the VIX Index? (MarketBeat)

Strategy

Two Q&A sessions for the price of one. (Pragmatic Capitalism)

Are you an overconfident trader? (SMB Training)

The golden age of stockpicking is here. (MarketBeat)

David Dreman talks about his latest book Contrarian Investment Strategies: The Psychological Edge. (Morningstar)

Companies

Netflix ($NFLX) is a company in search of a new business model. (Fortune)

Wells Fargo ($WFC) vs. JP Morgan ($JPM): dividend payers compared. (YCharts Blog)

Finance

What it takes to be a buy-side trader these days. (Advanced Trading)

Bank stress tests by their nature are backward looking. (Term Sheet)

Calpers is slowly recognizing reality with a marginal cut in its assumed annual rate of return. (WSJ, Pension Pulse)

Funds

Hedge fund launches surge in 2011. (Reuters)

Betterment vs. Wealthfront: a tale of the tape. (Tradestreaming)

Competition in the target date fund space is heating up. (Bloomberg)

ETFs

Why fund firms continue to launch new ETFs. (iShares Blog)

Three ETFs trading at a premium to NAV. (ETFdb)

ETF providers are doing a better job in reducing tracking error. (IndexUniverse)

Aggregate bond ETFs are pretty much the same. (Capital Spectator)

Global

The UK is thinking about issuing 100 year Gilts. (FT Alphaville, Crossing Wall Street, The Source, Macro Man)

Outside of Greece and Portugal country risk, per CDS prices, has come down. (Bespoke)

Economy

Okun’s law and why we could see further job gains amidst tepid growth. (Tim Duy)

What America sells to the rest of the world. (Planet Money)

Earlier on Abnormal Returns

Investment stories vs. anomalies. Which should you trust? (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

20 Twitter feeds all financial advisers should follow. (InvestmentNews)

Matthew Ingram, “It’s called curation if you like it, aggregation if you don’t” (GigaOM)

RIP, Encyclopedia Brittanica in print. (NYTimes also Howard Lindzon)

Abnormal Returns is a founding member of the StockTwits Blog Network.