Quote of the day

Robert Sinn, “Eventually the dumb money will get it wrong and overstay the party, however, the point is that the usefulness of these dumb/smart money indicators is heavily overstated particularly in trending market environments.” (Stock Sage)

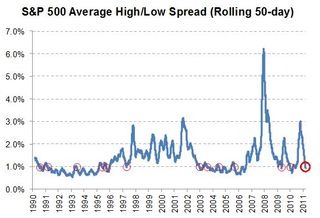

Chart of the day

What happens after a big drop in volatility? (Ticker Sense)

Markets

The story of the week was rising interest rates. (Money Game, ibid)

A look at relative S&P sector performance. (Dynamic Hedge)

Where 2012 stands in a look at the best starts to the year. (Bespoke)

Sentiment: still elevated. (The Technical Take)

Barron’s jumps on the housing has bottomed bandwagon. (Barron’s)

Oil

Europe wants an “oil shock” even less than the US. (voxEU)

Oil prices have been tracking along with expectations for a strike on Iran. (Money Game)

On the impact of $5 gasoline on consumer expectations. (Real Time Economics)

Strategy

Why you should buckle in for a lower equity risk premium. (Economist, NYTimes)

The cost of equity hedges are more expensive than appear on first glance. (Condor Options)

You have been warned: a noted market tell has gotten bullish on gold. (I Heart Wall Street also StockCharts Blog)

Companies

A look at “social era business models” at work. (Nilofer Merchant via GigaOM)

Seriously people, Apple ($AAPL) is getting really big. (Ultimi Barbarorum, Eric Jackson also StockCharts Blog)

Finance

Why the fuss now? Goldman Sachs ($GS) has been messing with clients for decades. (WashingtonPost)

Stock brokers have never held their customers in particularly high regard. (Total Return)

Why leveraged dividend recaps are waning. (Sober Look)

ETFs

How bond ETFs differ from equity ETFs. (iShares Blog)

Check the NAV of your junk bond ETF before buying. (Jason Zweig)

Comparing low volatility ETFs. (IndexUniverse)

Research on the return drag on leveraged ETFs. (SSRN via @quantivity)

Global

A look at the Irish economy on St. Patrick’s Day. (The Atlantic, Economic Interests)

Ukraine is jumping on the debt restructuring bandwagon. (Sober Look)

How to conduct a proper debt restructuring. (FT Alphaville)

Economy

The US economy in a certain respect is becoming less efficient. (Felix Salmon)

Should we get rid of time zones altogether? (Wonkblog)

Earlier on Abnormal Returns

What you missed in our Saturday long form linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Books

An excerpt from Steven M. Sears’ new book The Indomitable Investor: Why a Few Succeed in the Stock Market When Everyone Else Fails. (Barron’s)

It is hard to go wrong with Howard Marks’ The Most Important Thing. (Aleph Blog)

Five things Quintus Tulius Cicero can teach us about winning an election from How to Win an Election: An Ancient Guide for Modern Politicians. (Farnam Street)

Mixed media

Your daily dose of optimism. Peter Diamandis on our “abundant future.” (TED)

Has baseball become an inferior good? (Marginal Revolution)

Abnormal Returns is a founding member of the StockTwits Blog Network.