The idea that low volatility equities actually outperform their riskier brethren for many seems like a paradox. We thought the topic interesting enough to devote a section in our book to the idea of the low volatility anomaly. Given all the interest in the topic it isn’t surprising that the big ETF firms have jumped into the low volatility ETF fray. The biggest low vol ETF by assets, the PowerShares S&P 500 Low Volatility ETF ($SPLV) has outpeformed over the past year, but has lagged year-to-date.

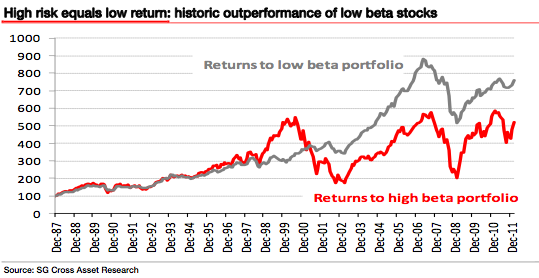

Joe Weisenthal at Money Game highlights a piece by investment strategist Dylan Grice on this very topic. Grice shows that over long periods of time low beta stocks outperform high beta stocks due in part to this:

Investors systematically overpay for high-volatility, high-beta stocks because they like the thrill (kind of like gambling or buying a lotto ticket) leaving a large swath of the market undervalued and underowned.

The graph below shows this effect:

Given all the interest in low volatility investing it should not come as a shock that analysts are looking for ways to put their own spin on the process. Joseph G. Paul writing at Institutional Investor notes that a low volatility strategy that focuses on high quality stocks outpeforms either strategy individually.

For a bit of historical perspective Eric Falkenstein at Falkenblog finds a very early academic paper on the topic. While the paper itself is flawed Falkenstein notes how the paper by Richard McEnally laid out four reasons, including overconfidence in risky stocks, to help explain these results.

None of the above should make you think that a low volatility portfolio is somehow risk-free. As seen in the current market rally, low volatility can underperform markedly. Managers who follow this strategy will likely experience periods of significant underperformance. The hope being that in times of more sedate markets a low vol strategy outperforms.

Items mentioned above:

Low volatility ETFs: a list. (ETFdb)

Dylan Grice on why investors so consistently overpay for “excitement.” (Money Game)

The earliest known article on the low volatility anomaly. (Falkenblog)

Adding value to low volatility by focusing on quality. (Institutional Investor)