Quote of the day

Michael C. Thomsett, “The [covered call] strategy is not a “sure thing” given that you still have to live with market risk.” (Minyanville)

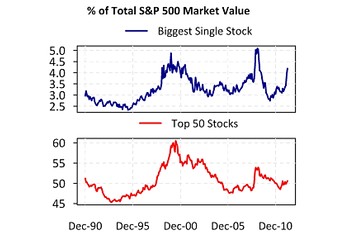

Chart of the day

Apple ($AAPL) aside the S&P 500 is not all that concentrated. (MarketBeat)

Markets

On the importance of establishing time frames in trading and investing. (Big Picture)

A quarter of S&P 500 companies are expected to see a drop in earnings in Q1. (The Reformed Broker contra Bespoke)

Newsletter writers are not all that bullish. (Mark Hulbert)

Why dividend payers see multiple expansion in a period of low interest rates. (Horan Capital)

Doing Mike Milken proud. The Market Vectors Fallen Angel High Yield Bond ETF ($ANGL) launches. (Focus on Funds, IndexUniverse)

Volatility

Tail risk insurance is getting pretty expensive. (FT Alphaville)

A look at the short and long term performance of $VIX ETPs. (VIX and More)

A simple strategy based on the VIX term structure. (MarketSci Blog)

Strategy

Buying funds at a discount to NAV often makes sense: a look at two recent examples. (GuruFocus)

What’s the deal with managed futures at tax time? (Attain Capital)

How the star system works against investment organizations. (the research puzzle)

“Why didn’t we own Venezuela last quarter?” (I Heart Wall Street)

Some recent readings on the equity risk premium. (Capital Spectator)

Companies

Bruce Berkowitz’s case for AIG ($AIG). (Market Folly)

When will smartphones achieve saturation in the US? (Asymco)

Time to fix iTunes. (MacWorld via @ampressman)

“Personal security” is the latest perk abused by corporate America. (Dealbook)

Finance

Tech firms are more willing to do deals without the help of Wall Street. (Huffington Post, Howard Lindzon)

The IPO market continues to attract filings. (Dealbook)

Why loan growth is so slow. (Bonddad Blog)

Repo reform still remains the Fed’s to-do list. (Dealbook)

The true challenge of private equity investing: excess returns are falling and driven by positive outliers. (Institutional Investor)

The state of high frequency trading on the markets. (Bloomberg)

Global

Shorting Chinese stocks is becoming a bit more complex these days. (FT)

China continues to loosen up restrictions on the Yuan. (WSJ)

A new, easier to use frontier market equity index. (beyondbrics)

Economy

More Americans think it is a good time to buy a home. But why? (Felix Salmon, Real Time Economics)

What the Zip Code Index is saying about housing. (Sober Look)

Good news: more Americans are quitting their jobs. (Real Time Economics)

Why has the Beveridge Curve shifted? (WSJ)

Updated projections for labor force participation rates. (Calculated Risk also The Atlantic)

Mixed media

Why your cable bills are so darn high. (paidContent)

Dueling review of Tyler Cowen’s An Economist Gets Lunch. (Marginal Revolution)

On the rise (and benefits) of personal analytics. (Justin Fox)

Earlier on Abnormal Returns

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed (social) media

How the job of business journalism has changed in the social media age. (Herb Greenberg)

Will the future of wealth management truly be virtual? (Tradestreaming)

Great notes for any one trying to break into financial blogging. (Phil Pearlman)

Abnormal Returns is a founding member of the StockTwits Blog Network.