Quote of the day

Charles Kirk, “Living a balanced life and getting away from the trading desk is much more important than most realize.” (Embrace the Trend)

Chart of the day

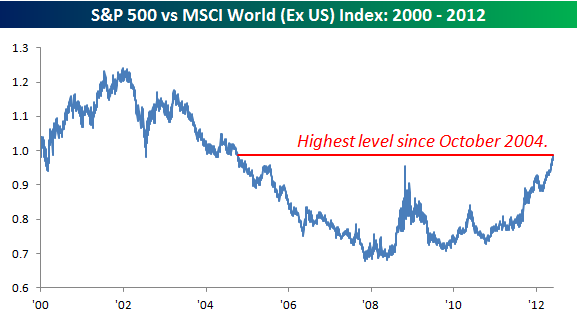

USA, USA, USA! (Bespoke also Sober Look)

Markets

Not surprisingly defensive sectors lead in May. (All Star Charts)

Just what is the all-time low 10-year Treasury yield? (Big Picture)

No inflation, growth, rampant fear, uncertainty and doubt=>record low yields. (Money Game, Calafia Beach Pundit)

Drudge Report financial headlines as a contrary indicator. (Bespoke)

Strategy

Beware the obvious trade. (Brian Lund)

Don’t dismiss companies with low dividend yields. (SmartMoney)

Debunking the goldbugs. (FT Alphaville)

Companies

Is Apple ($AAPL) ready to announce apps for Apple TV? (Daring Fireball)

Can Dell ($DELL) turn it around? (TechInsidr)

Finance

Remember when the publicly traded exchanges used to be thought of as growth stocks? Not any more. (YCharts Blog)

Post-Facebook we should take the private market transactions with a big grain of salt. (Felix Salmon)

Banks need a little more “hormonal diversity.” (Businessweek)

The IPO market is now on pause. (Dealbook)

The opportunity in bankrupt companies is not going away any time soon. (Distressed Debt Investing)

It is well past time for a new way to report corporate performance. (FT)

ETFs

Be careful when judging price moves in highly illiquid ETPs. (IndexUniverse)

ETF launches slow in May. (Invest With an Edge)

The AlphaClone Alternative Alpha ETF ($ALFA) is live. (IndexUniverse, AlphaClone)

Global

The Italian recession is beginning to look nasty. (Sober Look)

The renminbi keeps weakening. (FT Alphaville)

Brazil is cutting interest rates. (FT also beyondbrics)

Why China is already in recession. (The Atlantic, Humble Student of the Markets)

What if emerging market central banks stop accumulating the Euro? (Money Game)

Housing

Bill McBride on why housing prices are at an inflection point, and why it matters. (The Exchange, Real Time Economics)

Seriously people stop calling for a bottom in housing prices. (Big Picture)

Economy

Employment reports today (ADP and initial weekly unemployment claims) were a mixed bag at best. (Calculated Risk, ibid)

The Chicago PMI keeps weakening. (Real Time Economics)

Checking in on the GDP vs. GDI debate. (Wonkblog)

Human capital

Jeff Carter, “Why is hiring so tough? Because talented people don’t need you anymore.” (Points and Figures)

Startups are raiding universities for programming talent. (WSJ)

Breaking down the value of human capital into a bond, stock and residual value. (SSRN)

As college graduates increasingly congregate some cities are getting left behind. (NYTimes)

Earlier on Abnormal Returns

Investing is hard and then there’s gold. (Apmex)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Global internet traffic is set to triple over the next three years. (The Atlantic)

Daddy, what were compact discs? (NYTimes)

The SpaceX Dragon capsule returns to earth, or at least sea. (LATimes)

Abnormal Returns is a founding member of the StockTwits Blog Network.