Quote of the day

Gatis Roze, ” Don’t just read investment books or listen to trading “gurus”. Powerful insights and lessons leading to more profitable investing can be acquired in unconventional arenas.” (StockCharts Blog)

Chart of the day

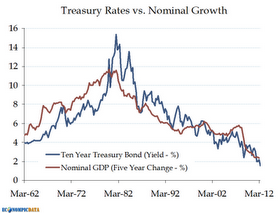

Nominal GDP matters for interest rates. (EconomPic Data)

Markets

Amateurs and professionals have very different views on the Euro. (UpsideTrader)

It’s going to take some time to rebuild this market. (Dynamic Hedge)

May was a tough month for active managers. (MarketBeat)

Strategy

Quant models are in disarray. (Reuters)

The buy-side needs to be more proactive in its approach to trading costs. (the research puzzle)

How do you benchmark an unconstrained portfolio? (Nerd’s Eye View)

Finance

MF Global highlights the dangers of the repo market. (Dealbook)

Former Bear Stearns execs agree to pay millions to settle shareholder lawsuits. (WSJ, FT)

FINRA looks to be the new regulator of investment advisers. (InvestmentNews)

Just how big is the wealth management industry? (Wealth Management)

Funds

More actively managed Pimco ETFs are coming. (InvestmentNews)

Should emerging market investors focus on dividends? (IndexUniverse)

Non-traded REITs underperform a relevant benchmark. (InvestmentNews)

Global

The world needs to hear a plan from Mrs. Merkel. (Economist)

How big a deal is Europe to the US economy? (FT Alphaville)

How the credit ratings gap between developed and emerging countries has narrowed. (FT)

The mess that is the UK economy. (Bonddad Blog)

Earlier on Abnormal Returns

What you missed in our Friday morning linkest. (Abnormal Returns)

Mixed media

Why HBO is not going to put its content online any time soon. (Slate)

Everybody, including Twitter, is a media entity these days. (GigaOM)

How to fix your weak passwords. (Slate)

Abnormal Returns is a founding member of the StockTwits Blog Network.