Quote of the day

Tim, “Someone who constantly expresses overprecise expectations is a danger, and the only person they’ll be generating money for is themselves.” (The Psy-Fi Blog)

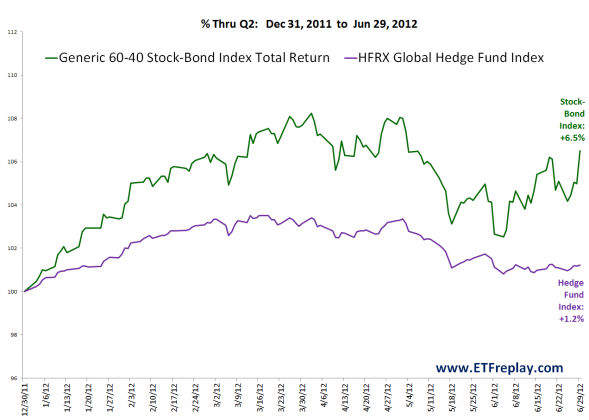

Chart of the day

Boring wins or why nobody makes money investing in hedge funds. (ETFReplay also Slate)

Stocks

Why it is so tough to short these days. (UpsideTrader)

Newsletter writers are bullish. (Marketwatch contra Humble Studnet)

Analysts have brought way down their Q2 earnings estimates. (Big Picture)

Are expectations too low? (Humble Student)

Checking in on the sector rotation model. (Afraid to Trade)

Other stuff

Investors can’t get enough investment grade corporate bonds. (Businessweek)

The heat wave and drought are crushing expectations for the corn and why it matters. (FT, Daily Ticker, Bonddad Blog)

The VIX

How does the $VIX affect relative strength returns? (Systematic Relative Strength)

Once and for all you cannot chart the $VIX. (Condor Options)

Strategy

Barry Ritholtz, “Stock picking is for fun. Asset allocation is for making money over the long haul.” (Big Picture)

Fundamentals matter less than you think. (Zikomo Letter)

Companies

Companies that have their act together don’t need to worry about the shorts. (Aleph Blog)

Sanofi-Aventis ($SNY) is a cheap, global pharma. (SumZero)

Union Pacific ($UNP) isn’t seeing widespread weakness. (Pragmatic Capitalism)

Private equity plays

The Carlyle Group ($CG) is betting big on an East Coast oil refinery. (WSJ, peHUB)

Blackstone ($BX) is betting on single family homes. (Bloomberg)

Libor

Libor explained. (Easy Street)

How deep does the Libor scandal run? (The Source)

What’s the alternative to Libor? (WSJ)

Did the BOE tell the banks to do it? (Money Game)

The regulatory structure didn’t keep up with Libor. (Money Supply)

Finance

The only people not in favor of breaking up the big banks these days are bankers. (NetNet)

Shockingly JP Morgan ($JPM) likes to sell its customers its own mutual funds. (Dealbook, The Reformed Broker)

One version of the future of active investment management. (Covestor)

ETFs

Why low volatility ETFs have become so popular. (ETF Trends)

The Pimco Total Return ETF ($BOND) is now the largest actively managed ETF. (Focus on Funds)

ETFs are finding their way into state 529 plans. (SmartMoney)

Does your S&P 500 ETF matter? (Focus on Funds)

Global

BRIC nations are pricing in serious economic weakness. (Bloomberg)

Why youth unemployment matters. (FT)

Economy

Factory orders surprise to the upside. (Reuters)

As do auto sales. (NYTimes, Bloomberg)

Earlier on Abnormal Returns

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

How you pay affects how much you spend. (Bucks Blog)

Tyler Cowen, “Everywhere will be like the music industry.” (The Atlantic)

Why are they already rebooting the Spider-Man franchise? (Grantland)

Abnormal Returns is a founding member of the StockTwits Blog Network.