Quote of the day

Jon Stein, “In my view, there’s virtually no advantage to mutual funds. ETFs use the pipes of the market, rather than one-off distributor agreements, so they are fundamentally more efficient.” (ETFdb)

Chart of the day

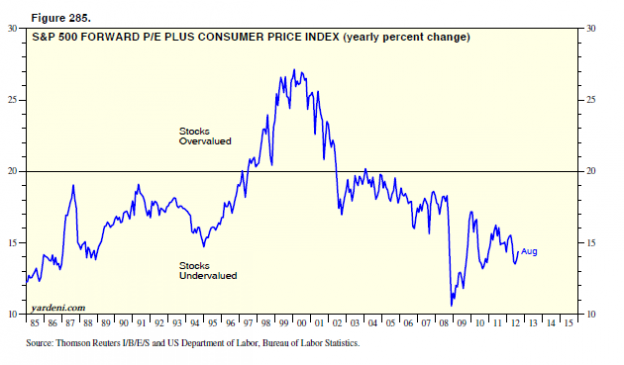

Just how well does the ‘Rule of 20‘ work in practice? (Dr. Ed’s Blog)

Markets

Just how scared should you be of the “dividend cliff“? (Musings on Markets)

Do biotech stocks exhibit seasonality? (CXOAG)

Fidelity now manages more cash and bonds than equities. (Reuters)

Strategy

On the value of subtracting noise for traders. (MartinKronicle)

Understanding the concept of “max pain” for traders. (Kid Dynamite)

A positive review of Ronald W. Chan’s The Value Investors: Lessons from the World’s Top Fund Managers. (Rational Walk)

Bonds

Convertible bond funds have had a couple of favorable decades. (Learn Bonds)

Banks have acquired a taste for muni bonds. (FT)

Why have TIPS been cheap relative to plain vanilla Treasuries? (SSRN)

Housing

More signs the housing recovery is in place. (Bonddad Blog, Sober Look, Big Picture)

QE has worked in collapsing the spread between MBS and Treasuries. (Calafia Beach Pundit, Sober Look)

30-year mortgage rates hit a record low. (AP)

ETFs

Fund managers are going to find it hard to resist launching active ETFs. (AdvisorOne)

There are two ETPs to play “wide moat” investment theme. (research puzzle pix)

Frontier market ETFs are heavy on financials. (Institutional Investor)

Economy

Weekly initial jobless claims declined, but other indicators show economic weakness. (Calculated Risk, MarketBeat)

The stock market likes higher inflation, get over it. (Capital Spectator)

A not altogether good sign from the Philly Fed for the US economy. (Reuters)

Thinking of economists as gardeners and not scientists or engineers. (macroblog)

Markets have a way of dealing with “shortages” and its called higher prices. (Slate)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

The neuroscience behind confirmation bias. (Guardian)

Why big companies can’t innovate. (HBR)

Why is it so difficult to correct errors? (Wired)

On the impossibility of meritocracy. (Stumbling and Mumbling)

Abnormal Returns is a founding member of the StockTwits Blog Network.