Quote of the day

Roger Nusbaum, “Bear markets start slowly over several months giving plenty of time to get out.” (Random Roger)

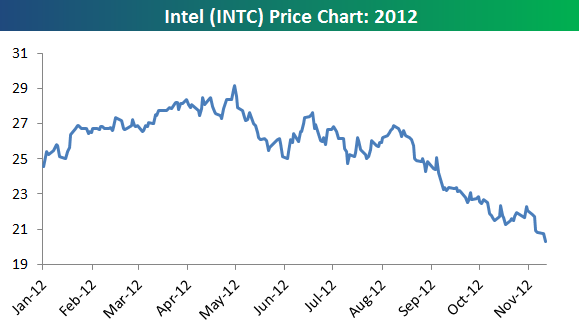

Chart of the day

Intel ($INTC) continues to plumb new depths. (Bespoke)

Markets

Why the market is rolling over: weaker earnings. (Money Game)

The most compelling argument for equities at present. (Pragmatic Capitalism)

The S&P 500 has been unable to mount 13x earnings since 2009. (Dr. Ed’s Blog)

Will the dividend cliff stop the rise in S&P 500 companies paying a dividend. (Political Calculations)

Are MLPs going to be a casualty of the fiscal cliff? (In Pursuit of Value, WSJ)

200 day moving average

Why has the 200 day moving average stopped working? (Mark Hulbert)

The Nasdaq Composite sits well below its 200 day moving average. (StockCharts Blog)

Strategy

On the nature of durable portfolio construction. (Systematic Relative Strength)

Unsolicited e-mails pitching stocks are safely ignored. (Aleph Blog)

Your trading style has to change with your stage of life. (Brian Lund)

There’s no Hippocratic Oath on Wall Street. (Forbes earlier Abnormal Returns)

Private companies

Dropbox is big: 100 million accounts big. (GigaOM)

A look at the financials of the much-hyped Bloom Energy. (Term Sheet)

What next for WordPress? Verticals. (Pando Daily)

Should startups go to conferences? (From the Crowd)

Companies

Google ($GOOG) ate the newspaper industry. (The Reformed Broker)

There is no shortage of Facebook ($FB) shares as another lock-up expires. (Bloomberg, Kid Dynamite)

Amazon ($AMZN) doesn’t like to tell people how its business is doing. (Quartz)

There isn’t much reason for Kmart to exist any more. (Businessweek)

Icahn vs. Hastings: a tale of the tape. (WSJ)

Finance

The most (and least) effective stock buyback programs. (Institutional Investor, ibid)

The last (and best) analysis of the Leucadia ($LUK)-Jefferies ($JEF) deal. (The Brooklyn Investor)

Financial products are coming to a big box retailer near you. (NYTimes)

Climate change is the new risk variable. (All About Alpha)

Just what constitutes a “high net worth” client these days? (Total Return)

Funds

One manager who does not mind holding a big slug of cash. (research puzzle pix)

The future of money market funds may very well be Treasury-only money market funds. (Focus on Funds)

Global

How’s the global economy doing post-trough? (FT Alphaville)

Why aren’t more central banks cutting rates? (Bonddad Blog)

Why has the UK recovery lagged the US? (Gavyn Davies)

The big assumptions underlying the forecasts surrounding energy in 2035. (Econbrowser)

Frontier investing exemplified: Myanmar. (beyondbrics)

Economy

The post-crisis US economy is doing alright: the politicians are at-risk of blowing it. (Money Game)

Retail sales declined in October. (Calculated Risk, Capital Spectator)

Does the Fed need ‘explicit policy goalposts’? (Tim Duy)

Earlier on Abnormal Returns

Announcing the end of our early morning linkfests. (Abnormal Returns)

Mixed media

The future of the book business is as a loss-leader. (Marginal Revolution)

The challenge of mainstream media blogging: the FT edition. (Felix Salmon)

Health

Fast food meals still pack a lot of calories. (medicalxpress via Mortality Sucks)

The health benefits of neuroticism. (The Atlantic)

The many ways in which working from bed is bad for your health. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.