Nothing says Christmas like a good investment book! So get the investment book lover on your list a copy of Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere today.

Quote of the day

Harry Browne, “Almost nothing turns out as expected. Forecasts rarely come true, trading systems never produce the results advertised for them, investment advisers with records of phenomenal success fail to deliver when your money is on the line, the best investment analysis is contradicted by reality. In short, the best-laid investment plans usually go wrong. Not sometimes, not occasionally — but usually.” (Marketwatch)

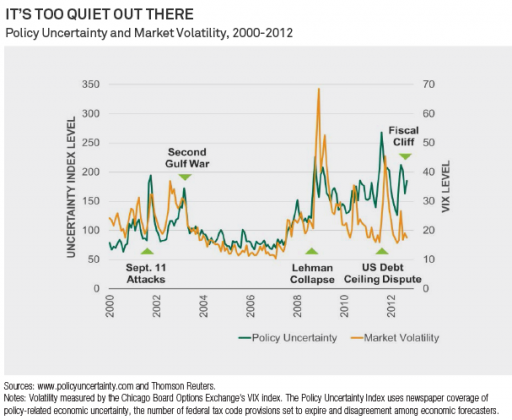

Chart of the day

The markets seem none too worried about the level of policy uncertainty at the moment. (Money Game)

Markets

GMO has ‘given up’ on traditional fixed income. (FT)

Why some markets need to ‘burn off’ their high relative valuations. (World Beta)

Analysts are looking at $113 in S&P 500 earnings next year. (Dr. Ed’s Blog)

Precious metals

Gold looks expensive. (Calafia Beach Pundit)

The metals markets seem to be prone to all manner of disinformation. (Kid Dynamite)

Muni bonds

Muni bond funds continue to seek inflows. (LearnBonds)

Illinois vs. California: in the muni markets the Golden State is pulling away. (WSJ)

A look at falling state CDS prices. (Bespoke)

Strategy

How to get back into ‘trading shape.’ (Brian Lund)

Embedded leverage is expensive leverage. (Focus on Funds)

Steven Sear’s recommended finance books. (Amazon Money & Markets)

Personal finance

A simple investing plan gives you time to live your life. (Vanguard)

Is it really a goal if you aren’t working toward it? (Bucks Blog)

Companies

Amazon ($AMZN) is taking advantage of low borrowing costs at the moment. (FT Alphaville)

There is blame aplenty for the disastrous acquisition of Autonomy by Hewlett Packard ($HPQ). (Musings on Markets, WSJ)

Why aren’t oil companies doing more to prepare for climate change? (Quartz)

Finance

So much for the apartment REIT IPO from Archstone. (WSJ, Deal Journal)

Special dividends are piling up before year-end. (WSJ)

Hedge funds are struggling these days without the benefit of ‘expert networks.’ (Dealbreaker, Dealbook, also Daniel Gross)

Concerted selling of a stock means different things at different times. (Felix Salmon)

ETFs

BATS is making a play for more ETF listings. (Ari Weinberg)

Charles Schwab ($SCHW) is getting into the actively managed ETF game with a $MINT rival. (IndexUniverse)

Global

Greece reaches some sort of debt deal. (FT, WSJ, FT Alphaville)

Japan is headed for debt monetisation. (Tim Duy)

Europe is down with some sort of Glass-Steagall type of split between investment and retail banking. (Institutional Investor)

Central banking

Why the UK wanted Mark Carney to head the Bank of England. (Money Game also The Source)

Three big challenges facing Carney at his new job. (FT, ibid)

Does the Fed chair need to be an American? (Felix Salmon)

Housing

Housing prices were on the rise in the summer according to Case-Shiller. (Calculated Risk, Big Picture)

The mortgage interest deduction is now seen as at-risk. (Dealbook)

Where are the first-time home buyers? (Fortune)

Mortgage delinquencies continue to fall. (Calculated Risk)

Economy

A history of the US economic recovery. (The Reformed Broker)

Durable goods numbers for October came in OK. (Quartz, Capital Spectator)

Are senior citizens squeezing youngsters out of the labor force? (FT Alphaville)

How big is the multiplier for federal highway grants? (FRBSF)

Health

Daisy Grewal, “People with dark personalities seem to be better at making themselves physically appealing.” (Scientific American)

Be careful drinking grapefruit juice with medications. (New Scientist)

The future of probiotics. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.