Quote of the day

Josh Brown, “The sold-out bull is desperate and his mind is twisted, every thought and expenditure of energy is employed toward the creation of a lower entry back into the markets. Only a cheaper buy-in will vindicate the earlier decision to sell that haunts him so.” (The Reformed Broker)

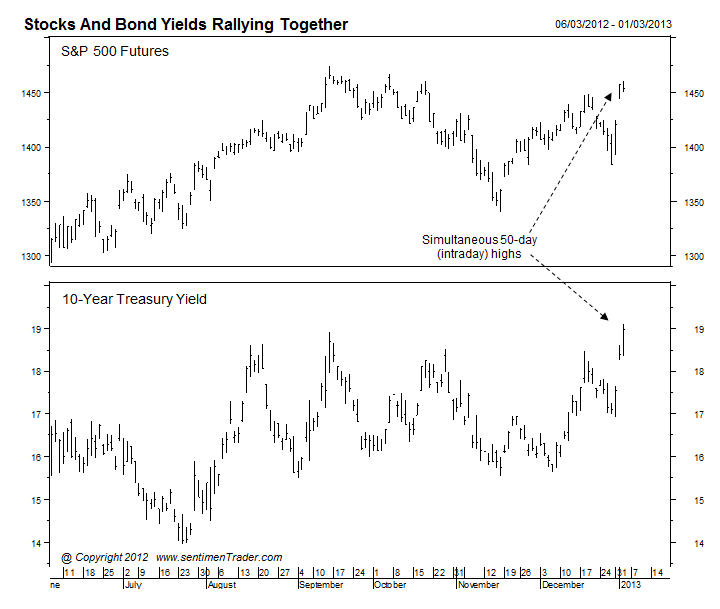

Chart of the day

Stocks and bond yields both hit 50-day highs. What next? (SentimenTrader)

Markets

The benefits of muni bonds came through the fiscal cliff intact. (Bloomberg)

How did piggybacking on hedge fund stock picks in 2013 work out? (World Beta)

Checking in on the slope of the yield curve. (research puzzle pix)

Has the nation’s social mood swung too negative? (Minyanville)

Strategy

Why investing sounds sexy and savings boring. (Pragmatic Capitalism)

How can investors avoid the siren song of the financial media? (Systematic Relative Strength)

Companies

Why you can’t rule out the influence of Steve Jobs on Apple ($AAPL) just yet. (Market Safari)

Boston Beer ($SAM) looks expensive. (SumZero)

Finance

How private equity and venture capital could work together in 2013. (Pando Daily)

Why mortgage rates are not headed much lower. (Term Sheet)

ETFs

Americans continue to pull money from actively managed equity mutual funds. (WSJ)

Contrarian alert: commodity ETFs were not hot in 2012. (Focus on Funds)

A look at the 102 ETPs that closed in 2012. (Invest With an Edge)

Global

Canada continues to pump out new jobs. (Globe and Mail)

What will the end of QE mean for the emerging markets? (beyondbrics)

Economy

An in-line December jobs report. (Calculated Risk, Money Game, Quartz, RTE, Bonddad Blog, FT Alphaville)

Why is the non-farms payroll number so seemingly predictable? (Felix Salmon)

Uncertainty gets reinjected into the QE debate. (WSJ, Sober Look, NYTimes)

Small businesses seems still mired in recession. (Sober Look)

Mixed media

Tumblr and Buzzfeed: compare and contrast. (paidContent)

Car companies are pushing the autonomous driving trend. (WSJ)

The end of history illusion: why we underestimate how much we will change in the future. (NYTimes)

Why don’t more pitcher learn the knuckleball? (Aaron Griggs via MR)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.