Quote of the day

William Bernstein, “As a dismal but useful rule, most good investment ideas eventually get run into the ground.” (NYTimes)

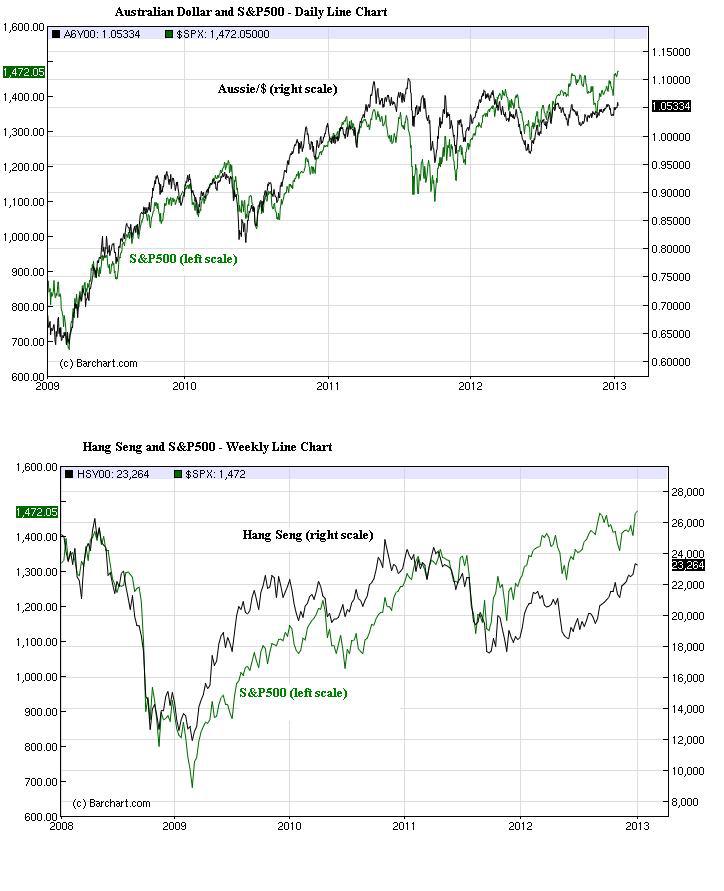

Chart of the day

Keep an eye on the Hang Seng Index as an indicator of risk appetites. (Global Macro Monitor)

Markets

The stock market continues to rotate into higher risk sectors. (Dynamic Hedge)

Don’t look now but the big cap tech sector is a yield play. (Floyd Norris)

Why does the stock market continue pushing higher? Earnings. (A Dash of Insight)

Wheat and corn prices are on the move. (FT)

Corporate profit margins have nowhere to go but down, or not. (World Beta)

Strategy

Lessons learned from the government’s Thrift Savings Plan. (Jason Zweig)

Why now is the time to get your financial sh*t together. (NYTimes)

Five lessons in investing from Charlie Munger and Warren Buffett. (Market Folly)

Finance

Ten big finance trends to watch in 2013. (Barry Ritholtz)

What does $5 million in investment banking fees get you? (Dealbreaker)

ETFs

Don’t pick a fund until you know it’s manager’s “active share.” (Barron’s, WSJ)

Expect to hear a lot more about actively managed ETFs in 2013. (Barron’s)

Economy

The trillion dollar coin is dead. (Wonkblog, Free exchange, WSJ)

Ten questions for 2013. (Calculated Risk)

A look back at the economic week that was. (Bonddad Blog, Calculated Risk)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Saturday long form linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

Why don’t more American’s get a flu vaccination? (Wonkblog)

The mess that is the baseball hall of fame balloting system. (FiveThirtyEight)

Why do financial bloggers blog? (Aleph Blog)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.