Quote of the day

Andrew McAfee, “I think what’s going on in my home industry of higher education at present is something between a bubble and a scandal.” (HBR)

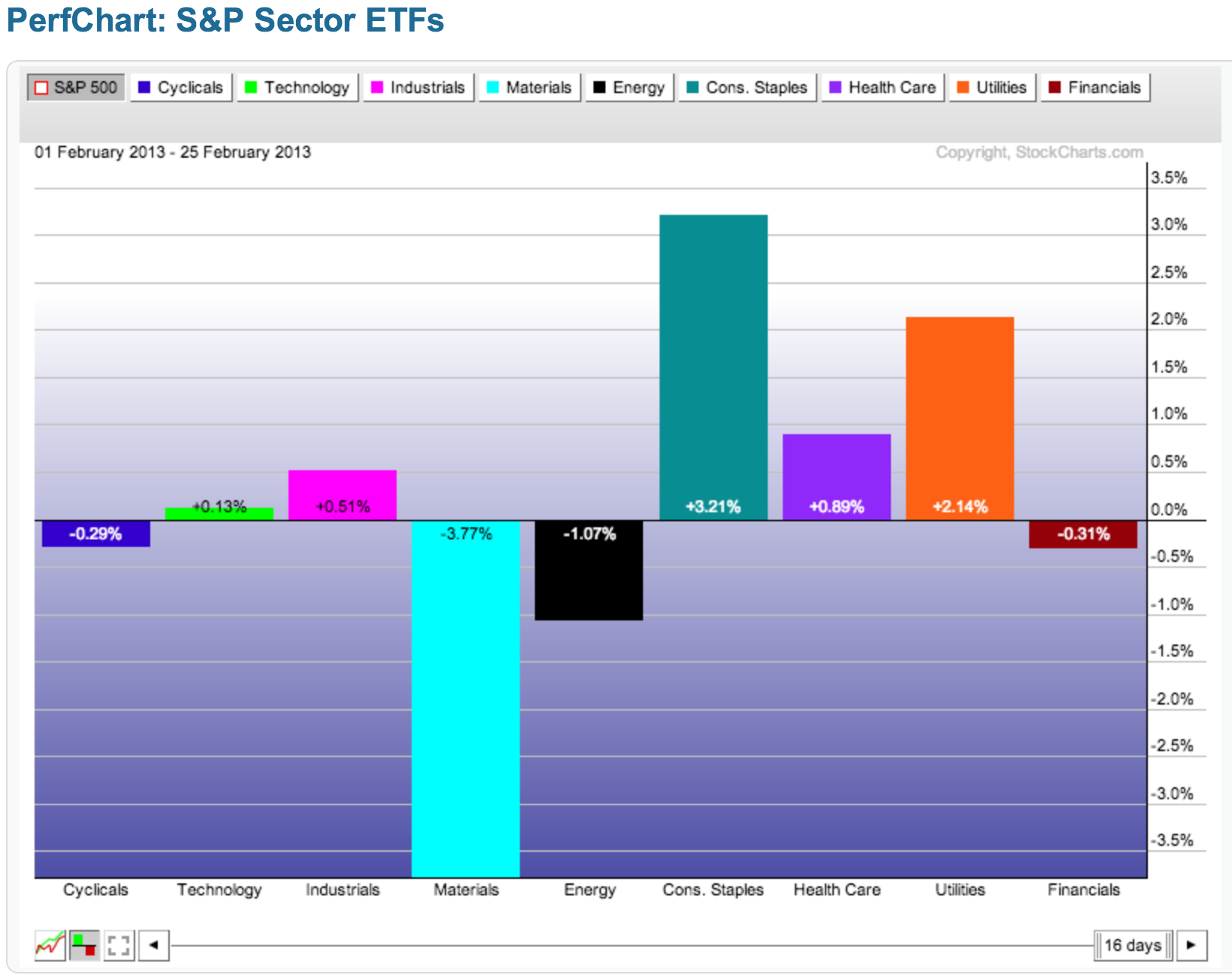

Chart of the day

Sector rotation in February has been decidedly defensive. (StockCharts Blog)

Markets

Markets are suddenly realizing it is a post-Presidential election year. (Stock Trader’s Almanac)

What new highs (and lows) are saying about the potential for a market top. (Mark Hulbert)

A look at the largest daily $VIX spikes. (VIX and More, Turnkey Analyst)

What next after a $VIX spike? (Condor Options, Quantifiable Edges)

Strategy

There is a huge disconnect between what the financial media covers and what investors actually need. (The Reformed Broker)

How to deal with a low (and rising) interest rate environment. (Learn Bonds)

Why does the spinoff anomaly persist? (Falkenblog)

Institutional investors

What is Greenlight Re ($GLRE) worth to David Einhorn? (The Brooklyn Investor)

College endowment funds would have done well to stick to a 60/40 portfolio. (Amazon Money & Markets)

Private equity returns ain’t what they used to be. (Turnkey Analyst)

Are activist investors taking advantage of “shareholder democracy” for their own short-term goals? (Dealbook, ibid)

Finance

What you need to have a well-functioning securitization market. (Dealbreaker)

The “pension fund hole” is not getting any smaller. (WSJ)

The public exchange “soap opera” continues apace. (Points and Figures)

ETFs

On the coming competition in the target date maturity bond ETF space. (IndexUniverse earlier Abnormal Returns)

The iShares Copper Trust is coming to market. (Focus on Funds)

Global

Deadlock in Italy! (WSJ, FT Alphaville, Quartz)

Italian elections shatter beliefs about the future of Europe. (Gavyn Davies)

China is set to rein in the shadow banking empire. (FT also WSJ)

Are debt levels rising in Asia at too fast a clip? (Time)

Economy

According to Case-Shiller home prices are on the rise. (Calculated Risk)

Stress testing the Fed’s balance sheet. (Bloomberg)

The coming R&D crash. (Wonkblog)

Earlier on Abnormal Returns

In pursuit of mediocrity or the high cost of active management. (Amazon Money & Markets)

Mixed media

What “House of Cards” means for Netflix ($NFLX) and digital in general. (SplatF)

The social web vs. reader subscriptions. (paidContent)

App.net is going wider. (Pando Daily, Quartz, Marco Ament)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.