Quote of the day

Henny Sender, “What do you do in a world where the Fed is supporting the price of virtually every security today but will not do so in an indefinite tomorrow?” (FT)

Chart of the day

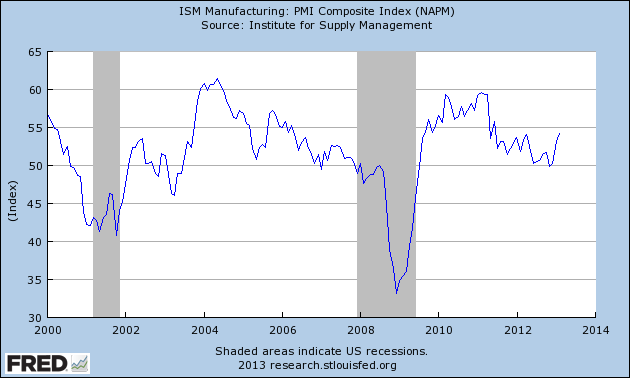

The ISM manufacturing survey surged in February. (Bloomberg, Real Time Economics, Crossing Wall Street)

Markets

How major asset classes performed in February. (Capital Spectator also Bespoke)

Day of the month seasonality for March. (MarketSci Blog)

Strategy

8 lessons learned from eating pizza. (Your Wealth Effect via @chicagosean)

Market timing doesn’t work. Don’t even try it. (Wealthfront Blog)

Using maximum drawdowns to measure tail risk. (Greenbackd, SSRN)

On the importance of a written trading journal. (StockCharts Blog)

Companies

Is Warren Buffett still on the hunt for large acquisitions? (WSJ, FT, Deal Journal)

What would cable look like if the bundle was gone? (WSJ)

Carl Icahn is getting married to Herbalife ($HLF). (Dealbreaker)

What Apple ($AAPL) should spend its cash hoard on. (Term Sheet)

Finance

Everything is cheap relative to bonds according to Stanley Druckenmiller. (Market Folly)

Hedge fund returns ain’t all that. (Pragmatic Capitalism)

Citigroup ($C) is kicking its internal hedge funds out. (Dealbook)

Funds

What people searched on Morningstar in 2012. (Morningstar via TRB)

An options and volatility ETP landscape. (VIX and More)

Global

The Euro economy is tanking with nothing to stop it. (Money Game)

No sign of a turnaround in Europe in the manufacturing data. (Bonddad Blog)

The search for yield in frontier markets. (Economist)

Economy

Auto sales were pretty good in February. (WSJ)

Americans ate out more in January. (Calculated Risk)

The jumbo mortgage market is still on fire. (The Basis Point)

Earlier on Abnormal Returns

Some good old fashioned (financial) media bashing. (Abnormal Returns)

Mixed media

Some nuggets from recent Berkshire Hathaway annual reports. (Deal Journal also Money Game)

Scott Adams, “Remind me why anyone trusts financial experts?” (Dilbert Blog)

Congrats on six years of blogging. (Aleph Blog)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.