This is an early (and incomplete) edition of the daily linkfest. Check in tomorrow for our weekly long-form linkfest.

Quote of the day

KD, “The mechanics of ETFs with easy create/redeem mechanisms like GLD are not rocket science..” (Kid Dynamite)

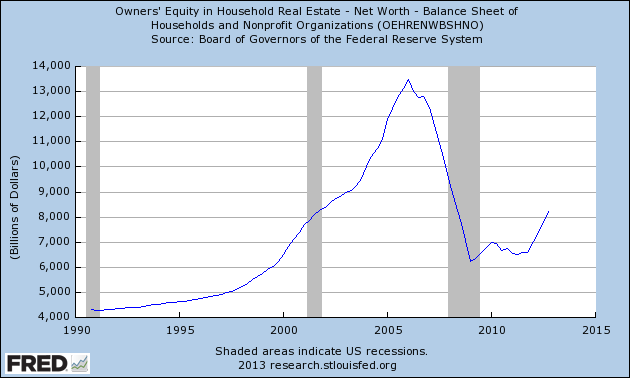

Chart of the day

A reason for hope: homeowner equity on the rise. (Slate)

Markets

Shareholder yield, dividends and share buybacks, is soaring for S&P 500 companies. (WSJ also FT)

Inflation matters: the real Dow is not anywhere near a new high. (Aleph Blog)

The S&P 500 is short-term overbought. (Bespoke)

Strategy

Allan Roth on “daring to be dull.” (IndexUniverse)

Are we investors trying too hard? (Greenbackd)

A nice review for Larry Swedroe’s Think, Act and Invest Like Warren Buffett: The Winning Strategy to Help You Achieve Your Financial and Life Goals. (Above the Market)

Companies

Loews ($L) is boring and undervalued. (The Brooklyn Investor)

The rise of private, but should be public, companies is attracting investor attention. (WSJ)

More speculation on the Time Inc. spinoff. (WSJ, NYTimes, FT)

Finance

Maybe Americans are doing a better job saving for retirement than previously thought. (InvestmentNews)

Carl Icahn, now stalking Dell ($DELL), is having quite an eventful “retirement.” (Dealbreaker also Term Sheet, Dealbook)

Floating rate notes are in vogue. (WSJ)

The banking system is still too leveraged. (Slate)

ETFs

The ETF Deathwatch for March 2013. (Invest With an Edge)

Global

Pairs trade alert: Australia vs. Canada. (Dynamic Hedge)

Why Canada’s economy is in trouble. (Sober Look)

Economy

Checking in on US economic data. (Money Game)

Rail traffic is rebounding quite nicely. (Pragmatic Capitalism)

The US has a long-term unemployment problem. (Slate)

Why the US is not Greece. (The Atlantic)

Earlier on Abnormal Returns

Leverage kills: the Apple edition. (Abnormal Returns)

Mixed media

App success is often fleeting at best. (WSJ)

How much is a piece of content worth? (Pando Daily)

Why you should have a cup of coffee at 2PM. (Quartz)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.