Quote of the day

Duncan Black, “The 401(k) experiment has been a disaster, a disaster which threatens to doom millions to economic misery during the later years of their lives.” (USA Today via Counterparties)

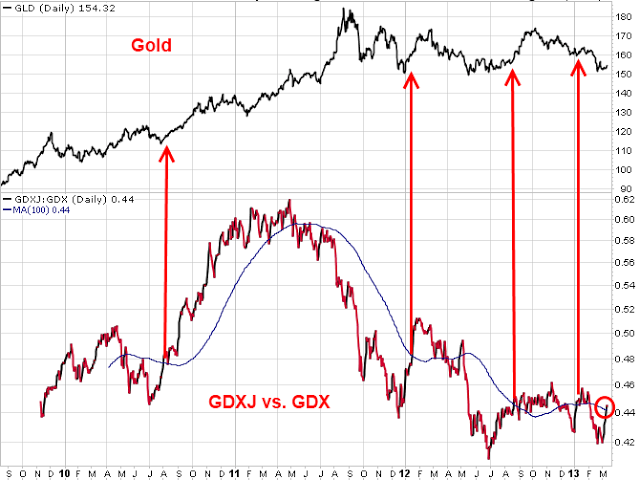

Chart of the day

The junior gold miners have begun to outperform the bigger cousins. (Charts etc.)

Markets

Where are the overbought conditions? (All Star Charts)

Is insider selling an issue? (Big Picture)

What’s eating emerging market equities? (Institutional Investor)

Checking in on currency performance YTD. (Buttonwood)

Rates

Interest rates will rise well before the Fed ever gets around to a rate hike. (Learn Bonds)

On the attraction of bank loan and floating rate funds. (Aleph Blog, iShares Blog)

On the downside of bond funds. (Horan Capital)

Strategy

How’d market timers do during this past cycle? Not so hot. (Mark Hulbert, Big Picture)

Ten things I wish knew before starting trading. (Brian Lund)

Why your investment time frame matters so much. (Big Picture also Random Roger)

Merger arbitrage returns aren’t all that hot. (Aleph Blog)

Seriously people: dividends matter. (Vitaliy Katsenelson)

What women want in a financial adviser. (InvestmentNews)

Companies

Apple

Intel ($INTC) is hoping to get back into the good grace of Apple. (Quartz)

Apple misses Steve Jobs’ ‘reality distortion field.’ (SAI)

Apple ($AAPL) is seriously contemplating a higher dividend and/or share buybacks. (Quartz)

How Apple gets all the good apps. (AllThingsD)

Finance

Carlyle Group ($CG) is lowering the gate to its funds. The question is whether you want to go in? (WSJ, research puzzle pieces)

Spinoffs are big business these days on Wall Street. (Dealbook)

How is Estimize doing against Wall Street estimates? (Covestor)

ETFs

Fidelity and Blackrock ($BLK) expand their ETF partnership including more commission-free ETFs. (Focus on Funds, IndexUniverse, Chuck Jaffe, ETF Trends)

What the Fidelity announcement says about the plans for their own ETFs? (Focus on Funds)

How Pimco and Schwab got into the $10 billion ETF assets club. (FT)

Are ETFs in practice more tax-efficient than mutual funds? (Morningstar)

Schwab and Vanguard are once again in an price war. (FT)

The ten most exotic ETFs. (IndexUniverse)

Global

Spain’s economy is slightly less horrible than it was. (Sober Look)

Chinese ‘ghost towns’ are not as prevalent as commonly thought. (Money Game)

Why Germany avoided the worst of the Euro crisis. (Quartz)

How Turkey won in the aftermath of the Iraq war. (FT)

Economy

Retail sales continue to show strength. (Calculated Risk, Capital Spectator, Money Game)

The ‘resilient consumer‘ is a myth. (MarketBeat, GEI)

Is the stock market indicating a better economy? (Term Sheet)

Higher overtime is pushing factories to hire. (Bloomberg via MR)

Technology

Google Fiber is awesome but unnecessary. (Slate)

The price of Amazon Prime may be coming down. (Wired, GigaOM)

Netflix ($NFLX) is getting all social. (Bloomberg)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.