Quote of the day

John Gapper, “It may give Mr Lipton apoplexy, but there is no harm in investors challenging executives and a board of directors if they are hoarding cash from caution or laziness.” (FT)

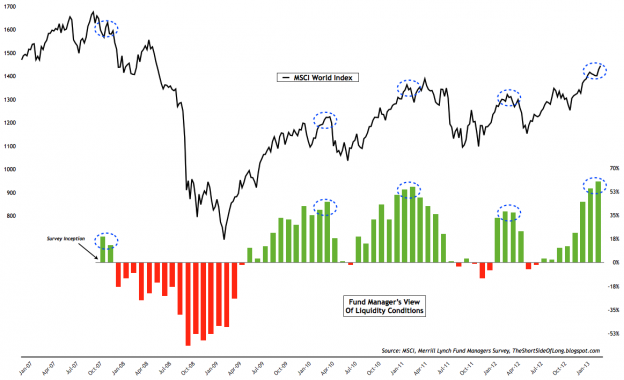

Chart of the day

Is this as good as it gets liquidity-wise? (The Short Side of Long)

Markets

Why rising home prices are more important than the stock market for the economy. (The Reformed Broker)

Lower profit margins need not imply lower profits. (Dumb Money)

S&P 500 operating EPS estimates are overoptimistic. (Greenbackd)

Strategy

On the importance of taking yourself out of the loop. (Pragmatic Capitalism)

How you know when you are truly a trader. (Brian Lund)

On the risks of a risk parity strategy. (Turnkey Analyst)

Hedge funds

Do hedge fund of funds add value? (Turnkey Analyst)

How financial incentives change for hedge funds over time. (aiCIO)

Why most money managers don’t use Twitter. (Chuck Jaffe)

Finance

A sign of the times: the CME ($CME) is looking to offload trading real estate. (WSJ)

There’s not a lot of downside when bank execs go into government. (Dealbook)

What would a TBTF ETF look like? (Big Picture also Bespoke)

Real estate

Once again the US housing recovery is on track. (Quartz)

Homebuilders have been left flatfooted in the face of rising demand. (NYTimes)

Check out the growth in mortgage REITs. (FT Alphaville)

Don’t look now but real estate investing is going the crowdfunding route. (Pando Daily, The Verge)

Global

How did Cyprus become this important? (Bonddad Blog)

China PMIs: back to bullish. (FT Alphaville)

On the declining risk of emerging market bonds over time. (iShares Blog)

Economy

Weekly initial unemployment claims continue to point towards a better labor market. (Calculated Risk)

Fed policy is likely on hold “for a long time.” (Tim Duy)

Five takeaways from the FOMC announcement. (Real Time Economics)

Earlier on Abnormal Returns

Focus on Norway, not Cyprus. (Abnormal Returns)

Mixed media

How YouTube has evolved into a billion user beast. (Pando Daily)

LED light bulbs are becoming increasingly affordable. (NYTimes)

Why you should wear red in your dating profile. (Slate)

Bezos Expeditions recovers Apollo rocket engines from the Atlantic Ocean. (Wired)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.