If you haven’t done it already think about signing up for our daily e-mail, thousands of other Abnormal Returns readers already have.

Quote of the day

Matt Krantz, “The stock market is shrinking. The number of companies that individual investors can buy shares in is in a breathtaking decline, continuing a fall that’s been years in the making but that’s accelerated this year with its record-breaking start to takeovers, mergers and buyouts.” (USA Today via CWS)

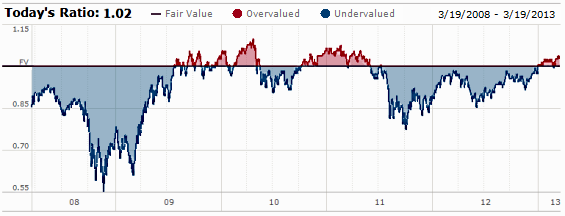

Chart of the day

Hard to say the stock market is undervalued. (Morningstar)

Markets

Bears are in short supply. (The Short Side of Long)

Sentiment analysis is not a precise timing tool. (Dynamic Hedge)

Market breadth is ebbing away. (Market Montage)

Cyprus is just a big “noise festival.” (Phil Pearlman)

Why gold miners have lagged. (Morningstar)

It’s boom time for US railroads. (WSJ)

Muni bonds are rolling over. (Dragonfly Capital)

Strategy

We are all active investors, nee savers. (Pragmatic Capitalism)

Everybody reaches for yield: including insurance companies. (SSRN)

How stock analysts do their job. (CXO Advisory Group)

How momentum is generated in the short-run. (Turnkey Analyst)

Break time

Why you need to step away from the screens to become a better, more balanced trader. (The Trading Book)

Green spaces lessen brain fatigue. (Well)

Focusing your mind with Heidi Hanna’s The Sharp Solution: A Brain-Based Approach for Optimal Performance. (Reading the Markets)

Companies

Warren Buffett’s career in 1000 words. (Aleph Blog)

Bond investors are none too fearful of the Heinz ($HNZ) deal. (Fortune)

Finance

The paradox of an all-indexed strategy for Calpers. (Dealbreaker)

Corporate boards with women outperform. (Quartz)

ETFs

The problem when ETF issuers get involved in commission-free programs. (IndexUniverse)

Three rotation strategies for ETFs. (ETFdb)

Global

Why the ‘oil age‘ may be coming to an end. (FT Alphaville)

There really is no upside for Cyprus. (Fortune)

The global pool of AAA credits is shrinking. (FT)

France is still in trouble. (Bonddad Blog, BCA Research)

Earlier on Abnormal Returns

Ten influential blogs for financial advisors. (Financial Planning)

Mixed media

The speed vs. battery life issue keeps getting worse for smartphone buyers. (Slate)

Why doesn’t iCloud just work? (The Verge)

The power of RSS. (Marco Ament)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.