Quote of the day

Meir Statman, “The real risks in life are not the stock market. If you want risk, get married. And if you want more risk have children.” (InvestmentNews)

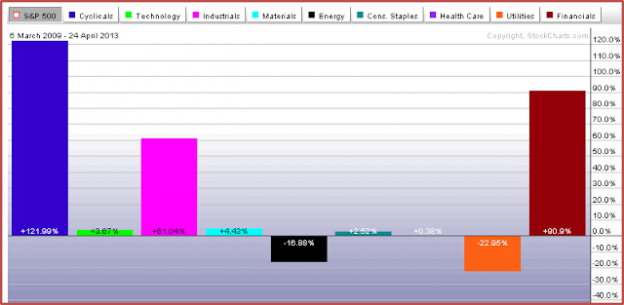

Chart of the day

What sectors performed best since March 2009? (Charts etc.)

Markets

Cyclical stocks don’t necessarily lead the stock market in bullish years. (Money Game)

On the parallels between the Internet and solar bubbles. (RiskReversal)

The slope of the $VIX curve has been spiky in 2013. (Condor Options)

Day of the month seasonality for May. (MarketSci Blog)

Strategy

What happens if we take indexing to its logical extreme? (AdvisorOne)

What is deep value investing? (BeyondProxy)

What’s important about money to you? (Bucks Blog)

Companies

Apple ($AAPL) is set to sell up to $20 billion in bonds with the help of Goldman Sachs ($GS). (Bloomberg, Quartz, Money Game, Learn Bonds)

Just how good is the new Google search app? (The Atlantic)

Why Amazon ($AMZN) isn’t all that worked up about an Internet sales tax. (FT)

Finance

How do M&A deals get leaked? (Dealbook)

Now company boards are getting some insider trading scrutiny. (WSJ)

Do private equity investors want a one-size fits all solution? (Term Sheet)

Why do institutional investors favor private real estate funds over REITS? (Institutional Investor)

Why crowdfunding rules have been slow to roll out. (WashingtonPost)

ETFs

Yield-related ETPS are ruling the roost. (IndexUniverse)

Don’t forget the difference between bank loan funds and floating rate bond funds. (Morningstar)

Global

It is good news for the Euro if banks are able to shore up their balance sheets. (MoneyBeat)

Just how bad is Euro unemployment? (FT Alphaville)

Can the Fed shrink its balance sheet like Sweden did? (Fatas & Mihov via @markthoma)

Economy

According to Case-Shiller housing prices are up some 9% year-over-year. (Calculated Risk, Developments)

US government debt is set to shrink in Q3. (Money Game, FT)

How does the macro-markets risk index look? (Capital Spectator)

Just how concerned is the Fed about disinflation? (Tim Duy)

Just how much play is the shale gas revolution going to have on transportation? (FT Alphaville, Slate)

Earlier on Abnormal Returns

On the similarities between ‘being early’ and ‘not knowing what you have’: the case of TheStreet.com. (Abnormal Returns)

Finance blogging is not for the faint of heart. (Pieria)

Mixed media

Do we need to cool down after exercising? (Well)

Grocery delivery is greener than driving yourself to the store. (Seattle PI via Pat’s Papers)

Hummus is the hot, new trendy food. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.