Quote of the day

James Surowiecki, “It’s still possible that investor hysteria could eventually inflate stock prices, or that investor panic could send them crashing, but there is no profit bubble and, for now, no stock-market bubble, either.” (New Yorker)

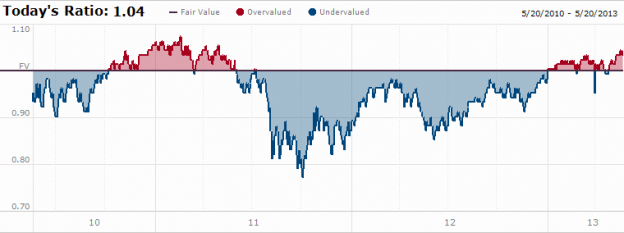

Chart of the day

Per Morningstar the stock market is nearing post-crisis high valuations. (M*)

Valuations

A valuation check on the stock market bubble talk. (Turnkey Analyst)

Some thoughts on elevated equity risk premium. (Musings on Markets)

The case for structurally higher corporate profit margins. (Money Game)

Markets

On the prospects for a market melt-up. (The Reformed Broker also Dr. Ed’s Blog)

Today’s market context does not show up in the history books. (Big Picture)

How QE2 has rippled through the markets, ending in equities. (Market Anthropology)

Markets seem to love political gridlock. (RCM)

Why exactly are silver and gold tanking? (MoneyBeat)

Strategy

Six ways to improve your trading consistency. (Kirk Report)

The real lesson Japan’s stock market surge. (Capital Spectator)

Beware the lessons learned from the ‘stock market game.’ (Marketwatch)

Does the ‘Magic Formula‘ work? (Old School Value)

Portfolio management

Simple advice is not easily followed. (Crossing Wall Street, Capital Spectator)

Rick Ferri, “Investing in bonds is a hedge against bad investment decisions.” (Rick Ferri)

Startups

Keep an eye on the balance between public and private markets. (Howard Lindzon)

Every startup can’t be run like a Google ($GOOG) clone. (Bijat Sabet)

Too much cash makes for bad decisions. (Crossing Wall Street)

Companies

There is a fair amount of skepticism about the Yahoo! ($YHOO)-Tumblr deal. (WSJ reactions AllThingsD, SAI, Fortune, GigaOM, Engadget, Felix Salmon, Wonkblog)

Some thoughts on Apple’s ($AAPL) big share buybacks. (TechCrunch)

Finance

Are US banks now being TOO aggressive in lending? (FT)

How Jamie Dimon became a risk factor. (Justin Fox)

Global macro hedge funds have changed their stripes. (FT)

Funds

The thinking behind the Cambria Shareholder Yield ETF ($SYLD). (IndexUniverse)

Individual investors shouldn’t obsess about their fund portfolios. (Chuck Jaffe)

The WisdomTree Japan Hedged Equity ETF ($DXJ) now has $10 billion in AUM. (IndexUniverse)

Global

Confidence is returning to the Japanese economy. (Quartz)

Air cargo volume is weak. (Pragmatic Capitalism)

Economy

The Chicago Fed National Activity Index slowed in April. (Calculated Risk, Capital Spectator)

The housing recovery still has some room to run. (Real Time Economics)

On the costs of dropping out of college. (Kids Prefer Cheese via @tylercowen)

Mixed media

Don’t worry about today’s retirees. (Fortune)

Investors are tapping their 401(k)s to buy homes. (CNNMoney)

A meeting is a meeting no matter what you call it. (FT)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.