Quote of the day

Greg Ip, “Equity risk premium and term premium sound like sophisticated economic concepts, but in reality they are statistical junk yards into which economists toss stuff they can’t explain with fundamentals.” (Free exchange via @ftalpha)

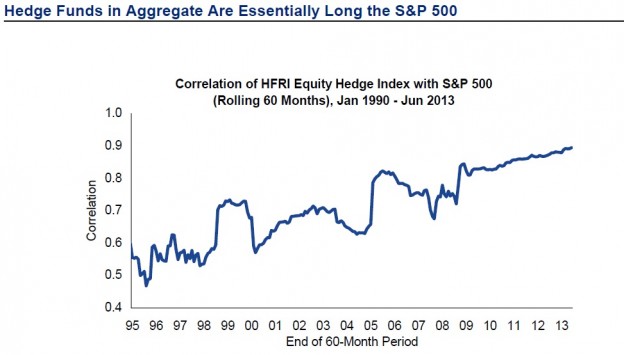

Chart of the day

Hedge funds are increasingly tracking the stock market. (Value Walk via Pragmatic Capitalism)

Markets

Brent and WTI are getting reacquainted. (FT, TheArmoTrader)

A lot of people still hate this market. (Joe Fahmy)

Why interest rates are likely to continue rising. (Learn Bonds)

The Nasdaq is going up without the help of Apple ($AAPL). (The Reformed Broker)

Strategy

You cannot fund your retirement with a quarter or two of returns. (Random Roger)

Three investment mistakes you are unlikely to admit. (Vanguard Blog)

You are asking the wrong questions about your investments. (Motley Fool)

Companies

What’s the problem with Sears Holdings ($SHLD)? It increasingly looks like it is Eddie Lampert. (Businessweek)

Deal activity is heating up in the biotech space. (Dealbook)

Everybody is spinning off their newspaper holdings. (Businessweek)

Finance

Early peeks at data from industry groups is widespread. (WSJ)

Now firms are co-locating to get faster access to federal data releases. (CNBC)

You can’t have hedge funds advertise without increased disclsure about returns and process. (Felix Salmon)

The financial sector is still too darn big. (Justin Fox)

The financial sector is complicated because the world is complicated. (Dealbreaker)

Economy

Have the robots come for the middle class? (Washington Post)

Signs that the US is turning into a rental culture. (Sober Look)

Why we need to bring the university back into the student loan discussion. (Guardian)

Earlier on Abnormal Returns

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Baseball

90% of a baseball game is time spent hanging around. (WSJ)

How many people still hand score baseball games? (NYTimes)

Wrigley Field is going to get a jumbotron. (Chicago Tribune)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.