Quote of the day

David Merkel, “Ideas in investing tend to streak, get overinvested, then die. This is one reason why I don’t believe articles about the death of various investment concepts…There are no permanently valid investment factors to beat the market.” (Aleph Blog)

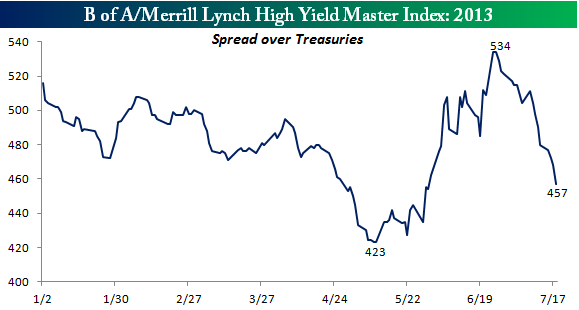

Chart of the day

High yield bond spreads have nearly reversed their recent rise. (Bespoke also WSJ)

Markets

The broader stock market is breaking out. (The Reformed Broker also StockCharts Blog)

The stock market has shrugged all manner of bad news. (Joe Fahmy)

Taking the other side of the “China is dead” meme. (Market Anthropology)

US stocks look rich relative to the rest of the world. (Wall Street Ranter)

Crude oil is sitting at 15-month highs. (StockCharts Blog)

Strategy

Good luck trying to find a manager who can consistently time the market. (Mark Hulbert)

A reason why seasonality works in the stock market. (A Dash of Insight)

Don’t forget the basics of investing. (Random Roger)

Why ‘smart beta‘ won’t save your portfolio. (Canadian Couch Potato via Monevator)

A recap of picks from the Delivering Alpha 2013 conference. (II Alpha)

Companies

Why Microsoft’s Surface RT failed. (Bits)

Why Apple needs iTunes Radio. (GigaOM)

Finance

How the big banks got into the commodity warehousing business. (NYTimes)

Banks are joining the cloud computing revolution. (Economist)

Funds

What are UITs and why are they booming? (Jason Zweig)

Diverging fixed income fund flows. (Sober Look)

Research indicated poor fund performance persists. (WSJ)

The iShares MSCI USA Quality Factor ETF ($QUAL) is launching. (ETF Trends)

Global

The dim sum bond market has gone cold. (FT)

Why has UK productivity flatlined? (Gavyn Davies)

Economy

What housing data should we pay attention to ? (Calculated Risk)

Wealth taxes are going to become a bigger issue on the policy stage. (NYTimes)

A look back at the economic week that was. (Bonddad Blog, Big Picture)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Don’t personalize the stock market. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

An excerpt from Rachel Herz’s That’s Disgusting: Unraveling the Mysteries of Repulsion. (WSJ)

Have we reached peak FroYo? (Daniel Gross)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.