Quote of the day

John Kay, “If we engineered the financial system with the same care and competence as the electricity network, financial crises would be less common.” (John Kay)

Chart of the day

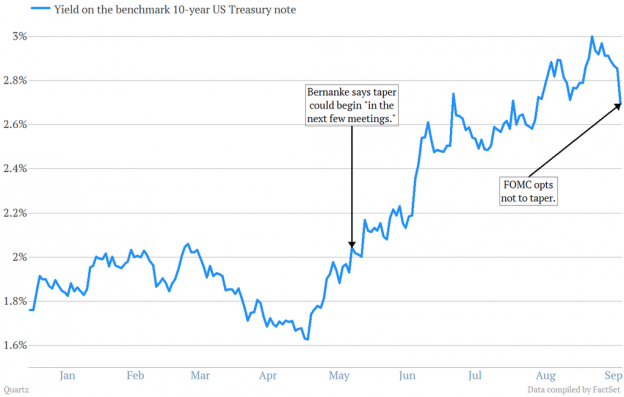

How much of the taper talk will get the 10-year give back? (@matthewphillips)

Markets

High yield sectors catch a break. (WSJ)

The stock market typically continues to rally after a Fed surprise. (Quantitative Edges)

What are net-nets saying about today’s stock market? (Old School Value)

On the importance of share buybacks to the stock market. (Dr. Ed’s Blog)

Strategy

On the behavioral basis of momentum strategies. (Turnkey Analyst)

Trend and valuation: all that matters. (Mebane Faber Research)

How to reduce investment noise. (Rick Ferri)

ETFs

The YieldShares High Income ETF ($YYY) is a way to play discounted CEFs. (ETFdb)

Low volume messes with ETF trading statistics. (IndexUniverse)

Global

Emerging markets catch a break in the no-taper decision. (NYTimes)

Hedge funds are coming to China. (Dealbook)

Economy

Initial weekly jobless claims continue to trend lower. (Calculated Risk, Capital Spectator)

The Fed

Did the Fed miscommunicate or are they just recognizing the reality of weak data? (Tim Duy, Mark Thoma, Justin Wolfers, FT, Slate, Quartz)

Don’t underestimate this Fed’s dovishness. (Gavyn Davies)

Has the Fed lost its hard-earned credibility? (Fortune, Value Plays)

QE may have some of its biggest effects on volatility. (Free exchange)

Pushing off the taper increases the importance of the new Fed chair. (Economist)

Rising stock prices doth not a successful monetary policy make. (Pragmatic Capitalism)

Earlier on Abnormal Returns

What’s on your investment blacklist? (Abnormal Returns)

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Coffeenomics

Why aren’t lower bean prices translating into lower latte prices? (Businesweek)

Why can’t any one make a decent cappuccino? (Business Insider)

Mixed media

Leonardo DiCaprio wants to make the Wall Street thriller, Graveland by Alan Glynn, into a movie. (Business Insider)

A review of John C. Maxwell’s Sometimes You Win—Sometimes You Learn: Life’s Greatest Lessons Are Gained from Our Losses. (Reading the Markets)

The shortlist for the FT and Goldman Sachs Business Book of the Year Award is out and includes The Billionaire’s Apprentice: The Rise of The Indian-American Elite and The Fall of The Galleon Hedge Fund by Anita Raghavan. (FT)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.