‘Tis the season to shop. Daniel Gross at The Daily Beast suggests you give the gift that keeps on giving: LED bulbs.

Quote of the day

Geert Rouwenhorst, “People have difficulty buying things for diversification purposes. But negative correlation is what it is. When one thing goes up the other thing goes down. You can’t have it both ways.” (FT)

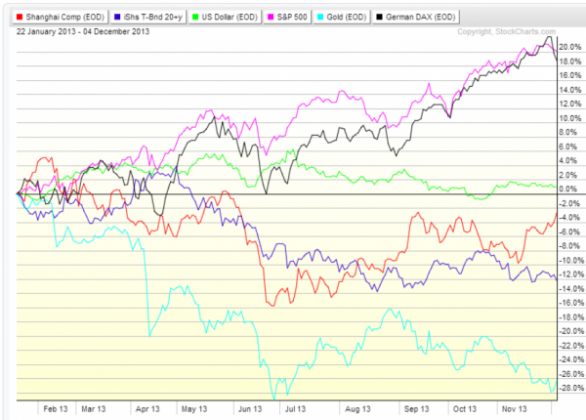

Chart of the day

Four lessons from 2013. (Dragonfly Capital)

Markets

Ten themes for 2014 from Rich Bernstein. (Business Insider)

What, if anything, can we learn from 25%+ years? (Pragmatic Capitalism)

The case for a reflation in assets like China and gold. (Market Anthropology)

Strategy

Should you invest your emergency cash? Um, no. (WSJ, Random Roger)

Simple models work better. (Mebane Faber)

What to look for in online investment management. (The Guardian)

Another example why default options matter so much. (Turnkey Analyst)

An interview with Steve LeCompte of CXO Advisory Group. (Rick Ferri)

Apple

Apple ($AAPL) reportedly signs a much awaited deal with China Mobile. (WSJ, stratechery)

Carl Icahn wants Apple to show him the money. (Time, Fortune, TRB)

Finance

What can Wall Street do to reverse its brain drain to tech? (Institutional Investor)

The sad state of hedge fund of funds. (WSJ)

Is Blackrock ($BLK) too big to fail? (Sheila Bair)

Peer-to-peer lending

Institutions want to grab a piece of the peer-to-peer lending space. (WSJ)

What happens next after all these P2P loans are made? (FT Alphaville)

Funds

The six best single country ETFs of 2013. (IndexUniverse)

Vanguard is the Wal-Mart ($WMT) of ETFs. (Bloomberg)

Fidelity is cutting fees on its target-date funds. (InvestmentNews)

Global

Would you rather have Brazil’s or the US’ economic problems? (Justin Fox)

Chinese banks may not play in the Bitcoin sandbox. (Bloomberg, FT, Quartz, Dealbook)

Newsflow in the UK has been pretty positive. (The Short Side of Long)

Economy

Weekly initial unemployment claims dip below 300k. (Calculated Risk)

More good news on the economic front. (Capital Spectator, Crossing Wall Street)

There is no housing bubble. (Bonddad Blog)

What the just-in-time rental economy might look like. (Slate)

Rich guys are driving economic research increasingly these days. (Felix Salmon)

What exactly is economic growth? (TheArmoTrader)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Matthew Harts’ Gold: The Race for the World’s Most Seductive Metal whizzes through the history of the shiny metal. (The Daily Beast)

On the economics of being an Uber driver. (Fortune also Slate)

Half your employees hate their jobs. (LinkedIn)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.