Quote of the day

Benedict Evans, “In a sense, then, one could suggest that smartphones liberate the internet from the browser in the same way that the browser liberated it from the command line. ” (Benedict Evans)

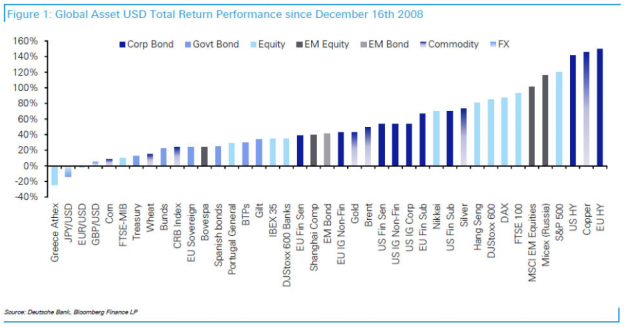

Chart of the day

Two of the best performing asset classes since 2008 are surprising. (The Short Side of Long)

Markets

Keep an eye on credit spreads. (Humble Student)

2013 was a tough year for call sellers. (Condor Options)

What matters more: earnings or the Fed? (Pragmatic Capitalism)

On the death of the contrarian. (FT Alphaville)

Muni bond CEFs are having a good week. (Focus on Funds)

Strategy

Valuation measures in only one country are not all that interesting. (Mebane Faber)

Investors should abandon strategic allocations to commodities. (FT Alphaville)

Companies

Darden ($DRI) is going to kick Red Lobster to the curb. (Dealbook, WSJ, Buzzfeed Business)

Chipotle ($CMG) IS etting into the pizza business. (Huffington Post)

Finance

2014 will be the year of the “secret IPO.” (Quartz)

Traders are looking far and wide for data to trade on. (WSJ)

Musings on identity in social finance. (Leigh Drogen)

How chatrooms were use to abet collusion in forex markets. (Bloomberg)

Funds

A checklist for fund investors. (Morningstar)

Vanguard is crushing the open-end competition. (InvestmentNews)

Is Fidelity getting into the alternatives fund business or not? (WSJ)

The case for an unconstrained approach to bond investing. (FT)

Adding momentum to the sector ETF scene. (Systematic Relative Strength)

Global

The case for emerging Europe. (IndexUniverse)

Germans don’t care for Twitter. (Economist)

Economy

The Fed begins tapering. (Tim Duy, (WSJ, FT Alphaville, Real Time Economics, Daniel Gross)

Why “the taper” really isn’t all that big a deal. (Business Insider, Pragmatic Capitalism, The Atlantic)

We are going to be living with the aftermath of QE for awhile. (Gavyn Davies)

How the Fed statement changed. (Real Time Economics, Aleph Blog)

Weekly initial unemployment claims tick higher. (Calculated Risk)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Mixed media

Nespresso is the Apple of single-cup coffee makers. (Pando Daily)

Despite nearly free long distance most people just call their neighbors. (Quartz)

Why we have all become numb to mobile ads. (Farhad Manjoo)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.