On the bookshelf: John Wasik’s Keynes’s Way to Wealth: Timeless Investment Lessons from the Great Economist.

Quote of the day

Joshua Brown, “Investors should treat CAPE measures the same way they do any other indicator: as one tool of many and about as inconsistently reliable as the rest of them.” (The Reformed Broker)

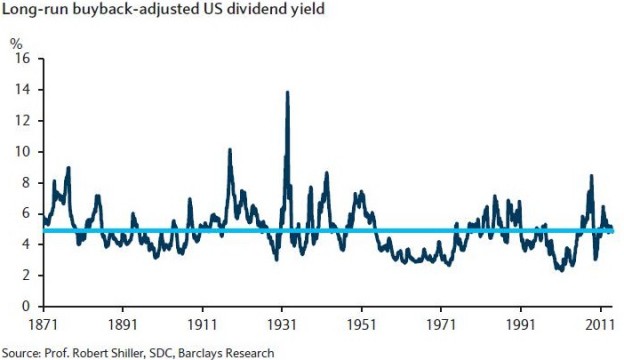

Chart of the day

By this measure the stock market is fairly valued. (FT Alphaville)

Markets

Goldman Sachs is not happy with the stock market’s valuation. (MoneyBeat)

The case for a low in gold. (The ArmoTrader, Market Anthropology, Minyanville)

Implied stock correlations are falling: stock pickers take heed. (Business Insider)

Strategy

Ten money lessons from older Americans. (Morgan Housel)

How bull markets lead investors astray. (The Psy-Fi Blog)

Companies

How healthy is the public technology market? (Tomasz Tunguz via @pmarca)

Amazon Prime has over 20 million subscribers. (Business Insider)

Google ($GOOG) is stepping up its patent portfolio. (FT)

Google is trying really hard to socialize its offerings. (Slate)

Why we are now truly in the “personal computing” age. (Asymco)

Old vs. social media: can they both thrive? (Michael Santoli)

Finance

The Fed is investigating banks over currency rate fixing. (Bloomberg)

As bond revenue falls banks are relying more on equity trading and underwriting. (FT)

Why dark pool volume continues to grow. (Securities Technology Monitor via @researchpuzzler)

Hedge funds are just expensive index funds these days. (Business Insider)

Pension funds are undertaking their own great rotation. (FT)

ETFs

Four innovative income ETFs launched in 2013. (IndexUniverse)

Vanguard continues to gain share in ETFs. (MoneyBeat)

Why Vanguard is a model for the fund industry. (Chuck Jaffe)

Social finance

How bloggers have democratized the market for economic opinion. (Barry Ritholtz)

Why companies distrust amateur analysts. (Talking Biz News)

Economy

Tapering is likely to continue. (Tim Duy)

The case for the breakout in business investment. (WSJ)

Rail traffic continues to expand. (Pragmatic Capitalism)

Debt refinancing is done. What next? (Bonddad Blog)

Should we be worried about slowing personal income growth? (Capital Spectator)

Earlier on Abnormal Returns

What you missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

On the gamification of the office. (WSJ)

Why commercial drone delivery is still a ways off. (TechCrunch)

How Bitcoin is like North Korea. (Business Insider)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.