Last year I once again got all excited when Credit Suisse released its annual global investment returns yearbook. It is a great reference source and I used some of the data in an earlier version of that publication to help me write my own book. Well it is that time of year again and the new Credit Suisse Global Investment Returns Yearbook 2014 is now out. Dimson, Marsh and Staunton the authors of the yearbook are also the authors of the much cited Triumph of the Optimists: 101 Years of Global Investment Returns.

In addition to their annual look at returns across a number of countries and time frames the authors take an in-depth look at three topics all of which are particularly timely:

- A long-term look at emerging market returns including factor returns;

- They examine the relationship (or not) between GDP growth and equities;

- An examination of time-weighted vs. asset-weighted returns or why investors buy high and sell low

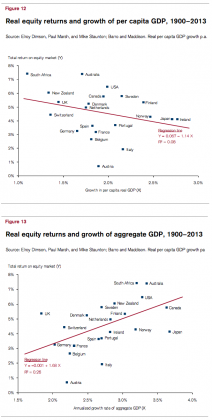

Speaking of #2 I have written before about the seemingly counterintuitive relationship between economic growth and equity returns. In the GIRY the authors show that the relationship is more complicated than thought. The negative relationship between real per capital GDP growth and equities holds but there is a positive relationship between population growth and equity returns. The key graphs below:

Source: Credit Suisse Global Investment Returns Yearbook 2014

So as I wrote a couple of yearbooks ago:

As I wrote last year:

In short, this document is a must-read. Sell-side research comes in for a lot of criticism of late from all corners of the blogosphere. However a document like this shows that there still is some great research being produced. And the price is right. You can thank me later for the recommendation….

Other mentions of the GIRY:

#1 read of the year. (The Idea Farm)

When population growth drives stock prices. (Buttonwood’s notebook)