You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Robert Seawright, “While lots of really smart people are using essentially all their time and vast resources trying to get ahead in the markets, a vanishingly small number of people are actually succeeding.” (Above the Market)

Chart of the day

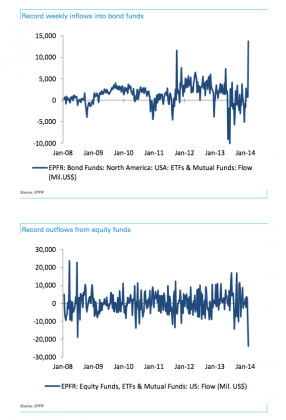

The great rotation was stopped in its tracks in January. (@matthewphillips)

Markets

Is it time to swap small caps for emerging markets? (TheStreet)

On second look emerging market stocks are not all that cheap. (Morningstar)

The valuation dispersion of S&P 500 stocks is pretty darn low. (Greenbackd)

The $VIX has fallen and breadth has risen. (Bespoke, ibid)

CEOs are noting the risk to profit margins. (Business Insider)

A notable divergence on gold. (Andrew Thrasher, Humble Student)

Apple

Everybody won in the Icahn-Apple ($AAPL) situation. (Bloomberg)

Trying to understand Apple’s high operating margins. (Asymco)

Finance

Non-listed REITs are made for brokers, not investors. (Simon Lack, TRB)

Mortgage REITS are buying shares in their competitors. (WSJ)

Blackstone Group ($BX) is in the midst of a selling spree. (Dealbook)

On the dearth of female hedge fund managers. (Dealbook earlier Abnormal Returns)

HFT

Steven Davidoff, “Markets now focus on drawing in high-frequency traders, and it seems that every entrepreneur has a stock market to peddle.” (Dealbook)

High frequency traders are experimenting with lasers to decrease trading lags. (WSJ)

Are the benefits of HFT overblown? (Noahpinion)

ETFs

Even though gold is down there is no shortage of new gold-based ETFs. (ETF)

Vanguard is getting into the model ETF game. (FT)

Global

When population growth drives stock prices. (Buttonwood’s notebook)

India has a corruption problem. (Fortune)

The case for the Global X FTSE Colombia 20 ETF ($GXG). (Random Roger)

Economy

Nothing from yesterday’s testimony to push Fed policy off track. (Tim Duy)

Can Janet Yellen really be a “high pressure” Fed chair? (FT Alphaville)

Why is the number of startups on the decline? (Reuters)

Earlier on Abnormal Returns

What you missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

People will believe anything in the pursuit of stock market profits. (Barry Ritholtz)

Airlines are having a hard time attracting pilots. (Businessweek, WSJ)

Why it is so hard to find that wine you had. (NYTimes)

You can support Abnormal Returns by visiting Amazon. You can also follow us on StockTwits and Twitter.