Quote of the day

John Gapper, “You cannot challenge fiat currencies and disrupt the global payments industry while reacting to any uninvited scrutiny like an adolescent whose parent has opened the bedroom door without knocking. It does not work that way.” (FT)

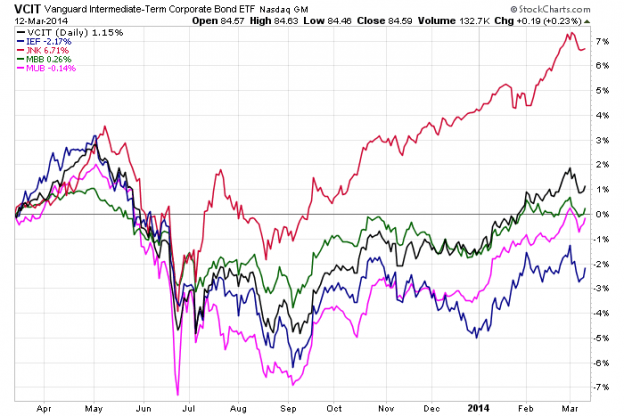

Chart of the day

Junk bonds have distanced themselves from other bonds. (Bonddad Blog)

Markets

Some popular market memes that are largely incorrect. (The Fat Pitch)

Market breadth remains strong. (Bespoke)

But divergences are setting up. (The Short Side of Long, AlphaNow, @sentimentrader)

Startups

Startup bubble? No so fast… (A VC)

Personal data is emerging as an asset class. (FT)

Strategy

Why does Berkshire Hathaway own so much DirecTV ($DTV)? (The Brooklyn Investor)

The downside of paper trading. (Brian Lund)

Traders are now hiring coaches to up their game. (Bloomberg)

Companies

Twitter ($TWTR) is the new CNN. (The Reformed Broker)

Just how risky is Candy Crush maker King Digital ($KING)? (The Exchange, HBR, WSJ)

How iBeacon and TouchID make for a killer combination. (Business Insider)

Amazon

The price of Amazon Prime is going up, but most users will re-up because it is worth it. (Recode, BI, )

Is Amazon ($AMZN) finally ready to make a profit? (Quartz)

Finance

How HFT synchronizes markets. (Physics of Finance)

Just how levered are American companies? (Andrew Smithers)

‘Covenant quality‘ continues to deteriorate. (FT)

On the birth of independent research in Japanese stocks. (Bloomberg)

ETFs

ETF volume is flattening out. (MoneyBeat)

Bank loan funds are hot. (ETF)

Guru ETFs are going global. (Random Roger)

Economy

Despite the weather retail sales were up in February. (Calculated Risk)

Startup Premise is trying to track macroeconomic trends in real-time. (TechCrunch)

Earlier on Abnormal Returns

What you may have missed in our Wednesday linkfest. (Abnormal Returns)

Autos

The downside of Apple’s ($AAPL) CarPlay and its competitors: distracted drivers. (Techpinions)

The engineering behind the reduction in F1 horsepower. (New Scientist)

Car dealers don’t like the idea of their business getting disrupted by Tesla’s ($TSLA) direct-to-consumer model. (WashingtonPost)

You can support Abnormal Returns by visiting Amazon. Don’t forget to follow us on StockTwits and Twitter.