Quote of the day

Joshua Brown, “So how can a professional avoid getting caught up in the next asset bubble? I’ve learned that taking on the right clients and setting expectations is the key.” (The Reformed Broker)

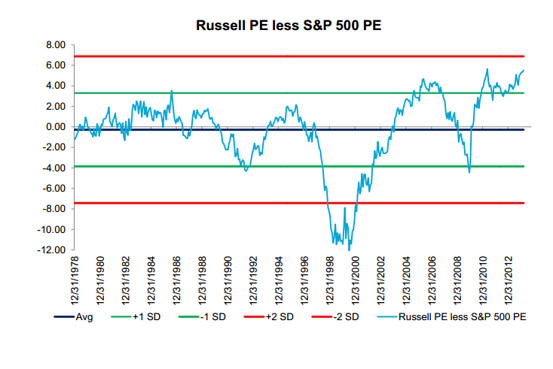

Chart of the day

Small cap stocks are historically expensive relative to large caps. (Focus on Funds)

Strategy

Some very different strategies go under the title of ‘value‘ these days. (25iq, John Authers)

A look inside the proposal of a big wealth manager. (Phil Demuth)

The not-so-hot performance of technical options traders. (SSRN via @jasonzweigwsj)

Apple ($AAPL)

The problem with CarPlay is automakers. (Monday Note)

A rare in-depth interview with Jony Ive. (Time)

Another sign that Apple is going to focus on health. (9to5Mac, TechCrunch)

Finance

Activist investors are running out of easy targets. (Reuters)

Don’t look now but ARMs are making a comeback. (WSJ)

Which investors drive gold prices. (Kid Dynamite)

How Thomson Reuters ($TRI) hopes to use Twitter ($TWTR) to compete with Bloomberg. (Institutional Investor also GigaOM)

Funds

Factor investing has gotten a tad too popular. (ETF)

Are ‘smart beta‘ strategies worth the effort? (WSJ)

Why fund managers prefer shiny new bonds to older corporate bonds. (WSJ)

Global

It should not be surprising that big Russian stocks trade at low single-digit P/Es. (FT Alphaville)

Putting the ‘I’ in BRICs. (The Reformed Broker)

Economy

A couple of FOMC week previews. (Calculated Risk, Business Insider)

Industrial production rebounded in February. (Capital Spectator, Calculated Risk)

The biggest problem with student debt lies with graduates of low-performing institutions. (Econbrowser)

A look at Tim Knight’s Panic, Prosperity, and Progress: Five Centuries of History and the Markets. (Reading the Markets)

Earlier on Abnormal Return

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Boxfish aims to make TV search smarter and more social. (TechCrunch, GigaOM)

What is Business Insider going to use with it’s new cash? (USA Today)

Which of the new mega-news sites will succeed? (Marginal Revolution also Pando Daily)

You can support Abnormal Returns by visiting Amazon. Don’t forget to follow us on StockTwits and Twitter.