You can keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have. Don’t miss out!

Quote of the day

Joshua Brown, “A lifetime of outperforming the markets is unattainable for most. But a lifetime of self-improvement and the acquisition of skill and knowledge – that’s available for anyone who’s willing to go for it.” (The Reformed Broker)

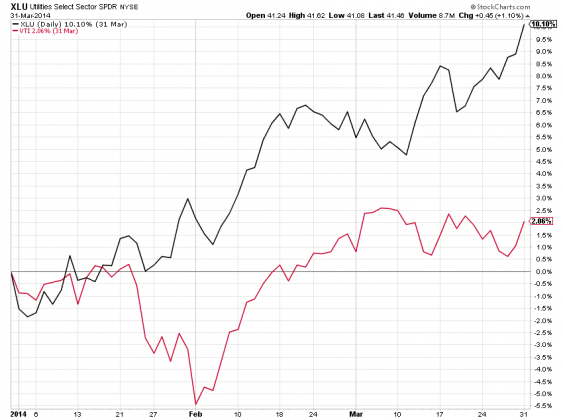

Chart of the day

Should we be concerned by recent strength in the utilities? (Pension Partners)

Strategy

As a trader you will be wrong a lot. Get used to it. (All Star Charts)

Five common “strategic edges” sought by discretionary traders. (TraderFeed)

How to handle a big gain. (A Dash of Insight)

Beware stock picks from your favorite pundit. (A Wealth of Common Sense)

Companies

When will companies begin to invest in earnest? (FT Alphaville, Barry Ritholtz)

Microsoft ($MSFT) is undergoing a fundamental change in strategy. (Business Insider)

What is going on with Google ($GOOG) shares today? (Daily Ticker, TechCrunch, FT)

Is the new Coca-Cola ($KO) compensation plan as big a giveaway as advertised? (The Brooklyn Investor)

HFT

Is Michael Lewis’ book Flash Boys: A Wall Street Revolt really such a revelation? (Slate)

Is the HFT boom already over? (The Week)

Whom to believe on the costs/benefits of HFT? (Rekenthaler Report)

Should ETF investors tune into the HFT debate? (ETF)

HFT has nothing to do with the direction of a stock. (LikeFolio Blog)

Justin Fox, “Yes, we should strive toward a market that’s rigged in the least expensive, most transparent, most efficient, most stable way possible.” (HBR)

Finance

Currencies are the new playground of high frequency traders. (Bloomberg)

Wealthfront is taking on more capital to take on the big boys. (TechCrunch)

Mortgage REITs are not all that. (Morningstar)

Funds

More signs that mutual fund companies are focusing on “alternative strategies.” (MFWire via @researchpuzzler)

Does the world really need a “Dogs of the Dow” strategy for the emerging markets? (Random Roger)

Pimco is looking more like a middle of the pack manager these days. (FT)

Economy

Real interest rates have been falling for decades. Why should we expect them to go much higher? (Real Time Economics)

The ISM services index increased in March. (Calculated Risk)

Weekly initial unemployment claims are hanging in there. (Calculated Risk)

On the rebound in North American rail traffic. (ValuePlays)

Earlier on Abnormal Returns

What books Abnormal Returns readers purchased in April 2014. (Abnormal Returns)

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Office for iPad is for a “different kind of work.” (WSJ)

Amazon ($AMZN) is getting generally favorable reviews for its streaming box the Fire TV. (TechCrunch, Gizmodo, BW, Slate)

It sounds like Mike Judge’s new HBO show ‘Silicon Valley’ is worth a watch. (Pando Daily, Slate, The Daily Beast)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.