Earlier this week I had a post up noting that despite the “monsters” of the personal finance industry there is a great amount of solid educational materials out there for investors. The sad reality is that most investors need some remedial education in investing. Howard Gold at Marketwatch is losing faith that investors are capable of anything but playing out tired patterns:

Not only do most individual investors not know what they’re doing; they seem incapable of improving, according to DALBAR, a Boston-based market-research firm that measures and evaluates practices of financial-services firms…

After citing familiar figures on how individual investors substantially underperform the market averages because of terrible market timing, the firm, which has reported these statistics for 20 years, calls out investors’ obtuseness and the miserable failure of the financial-services industry to change their dysfunctional behavior.

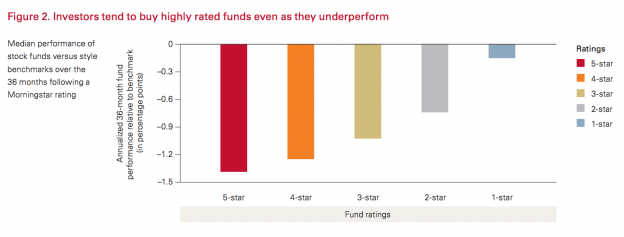

This need to chase performance and the often inevitable underperformance is noticeable in this chart from a recent Vanguard report: Vanguard’s Principles for Investment Success.*

This chart comes from the first of four sections of the report which are designed to help an investor put together a coherent and comprehensive investment plan:

- Goals: create clear and appropriate investment goals;

- Balance: develop a suitable asset allocation using broadly diversified funds;

- Cost: minimize costs;

- Discipline: maintain perspective and long-term discipline.

It should be surprising that these four bullet points jibe with what William Bernstein writes about in his new e-book for novice (Millennial) investors If You Can: How Millennials Can Get Rich Slowly. Not surprisingly the Vanguard report costs even less than Bernstein’s new book, $0.00. Investor who read, comprehend and implement a plan congruent with the above four points will be ahead the vast majority of their peers when it comes to investing. It may not be sexy but it is important.

Hat tip: Pragmatic Capitalism