Quote of the day

Brett Steenbarger, “If you read the biographies of successful traders, you’ll find that most were mentored by successful traders–and yet none ended up as clones of their mentors.” (TraderFeed)

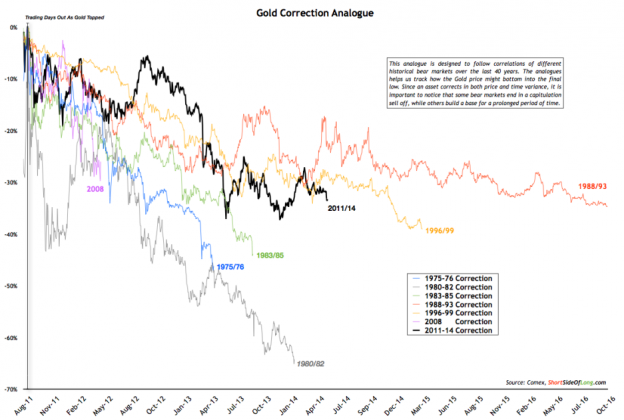

Chart of the day

Checking in on the gold bond market. (The Short Side of Long)

Bonds

Should we always listen to the bond market vs. the stock market? (Pragmatic Capitalism)

Demand for muni bonds has returned in the face of diminished issuance. (WSJ)

What does the bursting of a bond bubble look like? (A Wealth of Common Sense)

Investors are once again willing to lose money on bonds. (The Reformed Broker)

Markets

On the danger of an extended period of complacency. (Gillian Tett)

Don’t just look at the low level of the $VIX, look at the slope of the Vix curve. (Humble Student)

Companies

The food sector is becoming a bit of a free for all. (Dealbook)

Why is Amazon ($AMZN) pushing so hard on suppliers? (Bits)

Finance

Why would a hedge fund run another internal fund for employees? (Dealbook)

When will the corporate bond market feel the pain of diminished secondary dealers? (FT)

ETFs

Thinking about actively managed ETFs as an ‘out of the money’ call option. (Bloomberg)

Maybe smart beta is taking up the space everyone thought actively managed ETFs were supposed to take. (Focus on Funds)

Equal weighted strategies are expensive to implement. (Research Affiliates)

Global

Investors are picking over the wreck that is Spanish real estate. (Dealbook)

Thomas Piketty author of Capital in the Twenty-First Century is not backing down. (The Upshot)

Housing market

Homeowners are once again tapping their home equity lines. (WSJ)

On the state of the housing market. (Bonddad Blog)

Newly lowered mortgage rates are unlikely to further boost the housing market. (Sober Look)

Earlier on Abnormal Returns

The myth of the media diet: an excerpt from Joshua M. Brown and Jeff Macke’s Clash of the Financial Pundits: How the Media Influences Your Investment Decisions for Better or Worse. (Abnormal Returns)

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

Before you accept any invitation, ask yourself this question. (Slate)

How to get started in meditation. (Adam Grimes)

Tech moguls are buying up professional sports teams. (Quartz, ibid)

You can support Abnormal Returns by shopping at Amazon. Don’t forget to follow us on StockTwits and Twitter.