Do you have a personal investment philosophy? Can you write it down on a 3×5 inch index card? Likely not. As important as our investments are very few of us have gone to trouble of writing these ideas down and making them explicit.

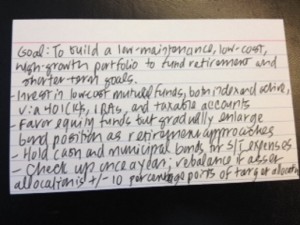

Christine Benz at Morningstar went through this exercise. You can see her handywork below. It is a sensible, middle of the road approach. One that is in keeping with her work at Morningstar. One thing that she mentions in her post is that this sort of “investment strategy on a note card” can serve as a jumping off point for discussions with a loved one or other advisor. It makes your investment approach explicit.

Source: Morningstar

Index cards aren’t just for investment strategies. Taken to their extreme they can encompass an entire personal financial philosophy. At the end of 2013 in a piece for Yahoo Finance I predicted that there would be “no shortage of self-serving financial advice that on the margin harms individual investors rather than helping them. In certain cases seeking out professional advice is not only advisable but necessary.” I went on to note that readers were unlikely to find better advice than that found on the index card below by Harold Pollack.

Source: Harold Pollack

As you can see the advice here is more wide-ranging. But in the end it covers most of the major decisions an individual needs to make in regards to their finances. This idea struck a chord with me and apparently with book publishers as well. Pollack along with Helaine Olen, author of Pound Foolish: Exposing the Dark Side of the Personal Finance Industry, are set to publish in early 2016 a book based on the index card above.

From description of the book at the Penguin Random House site.

From the acclaimed author of Pound Foolish and a highly respected University of Chicago professor, The Index Card provides all you need to know about money and investment in ten simple rules and shows you how to implement them.

When it comes to our money, many of us make the same mistakes over and over again. We are confident when we should panic. We believe that stock we heard about on CNBC or saw promoted on Twitter is the next Apple or Google. Or we find managing our money difficult and boring, and we don’t pay any attention at all. We neglect things. We toss our retirement statements in a drawer, planning to look at them on a future day that never arrives. We pay our bills the day before they are due. There is only one thing more confusing: all the you-can-have-it-all financial how-to books out there.

In The Index Card, Helaine Olen and Harold Pollack draw on years of experience researching and reporting on the financial lives of Americans to present an accessible, one-stop guide to taking back your financial future. The answers are simple enough to fit on an index card–an idea so user-friendly and helpful that Money magazine named it one of their Best New Money Ideas…

You can also pre-order the book from Amazon.

As you can guess the book from Olen and Pollack seems like something worth checking out. I enjoyed Olen’s earlier book and riffed on it in my own post on the topic of financial literacy. However there is nothing preventing each one of us from going through this very exercise ourselves. Carl Richards in his most recent book The One-Page Financial Plan talks about how going this sort of process helps us set priorities, that hopefully, match our goals with our means.

Writing things down, especially about money, can be a painful experience, but makes the implicit, explicit. The power of the index card is that it is the right amount of space to put relatively simple rules on to paper.