It has become an annual tradition here at Abnormal Returns to make a big stinking deal out of the release of the annual Credit Suisse Global Investment Yearbook. See posts from 2015, 2014, 2013 and 2012. This year is no exception. So rather than watching the market decline on a tick-by-tick basis why don’t you carve out some time and get a little (global) perspective on the capital markets.

In the 2016 Credit Suisse Global Investment Yearbook the Dimson, Marsh and Staunton, the authors of the yearbook and authors of the much cited Triumph of the Optimists: 101 Years of Global Investment Returns, are focused on central banks and interest rates. So in addition to their annual look at returns across a number of countries and time frames the authors take an in-depth look at three topics all of which are worth an in-depth look:

- A look at the market’s preoccupation with central bank actions;

- A comparison of asset class returns across an entire interest rate cycle and

- The effect of ultra-low real interest rates on savers.

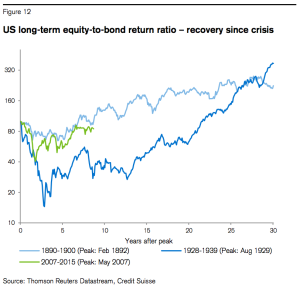

Speaking of low interest rates the authors note that investors will likely have to shift more into equities (and active strategies) in order to generate any kind of return going forward. If the prior crisis recovery periods are an apt comparison then we are in for a long term period of equity outperformance going forward.

Source: Credit Suisse

We are already seeing the unwinding of the risk-on trade in credit. I am sure market participants would like to see the logical follow-on, equity outperformance. They write:

For savers, particularly retiring baby boomers, ultra-low yields are little short of disastrous, especially given that a 100% allocation to bonds or annuities is the default option for retirees. More generally, the prospect of a decade or more of zero real returns on “safe” bonds poses a huge structural challenge to the fund management industry. Up until now, the investor response has been to move up the risk spectrum within fixed income, by increasing exposure to riskier credit and more illiquid investments, but this approach may be nearing its limits.

There is a reason why I recommend everyone download (and read) this document. Not only is it free but it provides both novice and experienced investors with some perspective on some very timely topics.

*For those of you who are too young, the title of this post alludes to a scene from the 1979 Steve Martin movie, The Jerk.