One of the benefits of having blogged for a long time is that you have a chance to see certain phenomena repeat over time. I wrote about the potential of low vol strategies in my book and in a 2013 post as well. One of the hot topics of late has been the recent outperformance of low vol strategies. Josh Brown at The Reformed Broker highlighted the performance of low vol, high dividend yield and defensive stocks in general. He calls it the “chicken bull.”

Source: JP Morgan via TRB

As Michael Batnick at The Irrelevant Investor notes this has come along with a surge in assets into low vol ETFs. So much so that the valuation on low beta stocks now significantly exceeds that of high beta stocks. This odd situation has led to some to argue for trying to time factors when their valuations get extreme. Jeremy Glaser at Morningstar notes these comments from Cliff Asness:

He [Asness] points to the benefit of a broadly diversified portfolio of factors as being a more important goal than just worrying about valuation.

John Authers at the FT notes that low or minimum volatility valuations are not that far out of whack historically. Far more important is the long historical record of low vol outperforming over time. Authers writes:

So the research suggests that min-vol is performing roughly as it says on the tin, limiting downside when the market gets rough, and gaining its strength from the tendency of investors to flock to stable and boring stocks in times of turbulence…So the case for min-vol looks robust, although its current valuation should signal some reason for concern.

Then again not everyone is convinced that the low vol effect is altogether robust. In “The Limits of Arbitrage and the Low-Volatility Anomaly” Li, Sullivan and Garcia-Feijóo argue that high transaction costs offset the returns from a low vol strategy. Jordan and Reilly in “The Long and Short of the Low Vol Anomaly” argue that there is a better strategy in the low vol-high vol universe. That being said the evidence for a low vol and minimum variance strategy is still pretty strong.

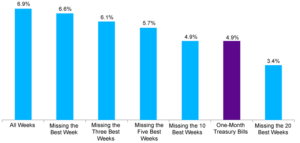

The risk investors face is in trying to time this, or any other factor, is missing important periods of performance that underlie their profitability. Michael Batnick writing at Enterprising Investor highlights the data for the equity market, or the granddaddy of factors, the equity risk premium. Not surprisingly he shows that if investors miss some of the market’s best weeks, that have a tendency to appear during bear markets, they can end up with no ERP.

Source: Enterprising Investor

In short, it’s hard enough finding a factor that you think will over time. It is infinitely more difficult to try and time that factor. As I wrote in a post three years ago:

Investors who think they can time the low vol effect, or any other effect, are acting as de facto market timers, not long-term investors seeking to exploit a market anomaly.

Investors would do well to focus on finding factor they believe, and the evidence shows, will work and leave the timing to others with far less conviction.