This month we did two Q&As with authors of recently published books. You can read our post with Spencer Jakab author of Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tile the Odds In Your Favor and our post with Tobias Carlisle co-author of Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors. You can also check out the previous edition of this linkfest, or our latest monthly post (June) of the most popular books among Abnormal Returns readers. Remember anything you buy from Amazon through these links goes to support the site. Enjoy!

This month we did two Q&As with authors of recently published books. You can read our post with Spencer Jakab author of Heads I Win, Tails I Win: Why Smart Investors Fail and How to Tile the Odds In Your Favor and our post with Tobias Carlisle co-author of Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors. You can also check out the previous edition of this linkfest, or our latest monthly post (June) of the most popular books among Abnormal Returns readers. Remember anything you buy from Amazon through these links goes to support the site. Enjoy!

Finance

Book Q&A: Some questions for Adam Butler co-author of Adaptive Asset Allocation: Dynamic Global Portfolios to Profit in Good Times – and Bad. (Alpha Architect)

Book review: Thomas Kirchner author of Merger Arbitrage: How to Profit from Global Event-Driven Arbitrage “describes the ins and outs of mergers in easily understandable prose.” (Reading the Markets)

Book adaptation: Baruch Lev and Feng Gu authors of The End of Accounting and the Path Forward for Investors and Managers argue that accounting no longer measures company performance. (WSJ)

Book review: Tensile Trading: The 10 Essential Stages of Stock Market Mastery by Gatis and Grayson Roze is great for those new to trading. (Reading the Markets)

Book list: 8 books Andrew Ross Sorkin recommends including Bloodsport: When Ruthless Dealmakers, Shrewd Ideologues, and Brawling Lawyers Toppled the Corporate Establishment by Robert Teitelman. (NYTimes)

Book Q&A: A discussion with Adam Kucharski author of The Perfect Bet: How Science and Math Are Taking the Luck Out of Gambling. (Washington Post)

Book notes: Matt Levine, “I tend to think of the Wall Street memoir as a sub-category of the addiction memoir.” and that includes For the Love of Money by Sam Polk. (Bloomberg View)

Book list: Some criminally overlooked books on finance and economics including Fifty Years in Wall Street by Henry Clews. (Fortune Financial)

Non-finance

Book review: Ordinarily Well: The Case for Antidepressants by Dr. Peter Kramer is “persuasive” and “invaluable.” (NYTimes)

Book notes: Daniel Pink finds a sweet spot for parenting from Angela Duckworth’s Grit: The Power of Passion and Perseverance. (Dan Pink)

Book list: Adam Grant author of Originals: How Non-Conformists Move the World recommends nine books including Amy Cuddy’s Presence: Bringing Your Boldest Self to Your Biggest Challenges. (Business Insider)

Book review: Disrupted: My Misadventure in the Startup Bubble by Dan Lyons is “very well written and funny.” (Value and Opportunity)

Book review: Charles Duhigg’s Smarter, Faster, Better: The Secrets of Being Productive in Life and Business contains some “brilliant storytelling.” (Scientific American)

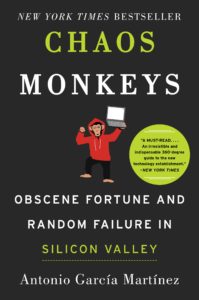

Book review: Chaos Monkeys: Obscene Fortune and Random Failure in Silicon Valley by Antonio Garcia Martinez is “a particularly compelling read, despite its faults.” (NYTimes)

Book list: 25 book recommendations from tech pioneers including The End of Average: How We Succeed in a World That Values Sameness by Todd Rose. (Business Insider)

Book list: Some books that MBAs think are useful including Bargaining for Advantage — Negotiation Strategies for Reasonable People by G Richard Shell. (FT)

Book list: Six books Richard Thaler recommends including the forthcoming Pre-Suasion: A Revolutionary Way to Influence and Persuade by Robert Cialdini. (Marketwatch)

Book review: Chaos Monkeys: Obscene Fortune and Random Failure in Silicon Valley by Antonio Garcia Martinez is “a valley account like no other.” (NYTimes)

Book review: “I think Shoe Dog by Phil Knight is the best memoir I’ve ever read by a business person.” (Brad Feld)

Book Q&A: A discussion with Anu Partanen author of The Nordic Theory of Everything: In Search of a Better Life. (The Atlantic)

Book list: The FT’s summer books of 2016 including The 100-Year Life: Living and Working in an Age of Longevity, by Lynda Gratton and Andrew Scott. (FT)

Book list: Books Tim Harford author of Adapt: Why Success Always Begins with Failure read in June including Algorithms to Live By: The Computer Science of Human Decisions. (Tim Harford)

Reading list: The Farnam Street members reading list including Peak: Secrets of the New Science of Expertise by Anders Ericsson. (Farnam Street)

Please check in with us on August 1st when we highlight the best-selling books on the site for July.