Book notes

Jeremy Miller looks at Warren Buffett’s early partnership letters in Warren Buffett’s Ground Rules. (Institutional Investor)

Quote of the day

Brad Feld, “One of the biggest challenges in tech is not being right. It’s being ten or fifteen years too early.” (Feld Thoughts)

Chart of the day

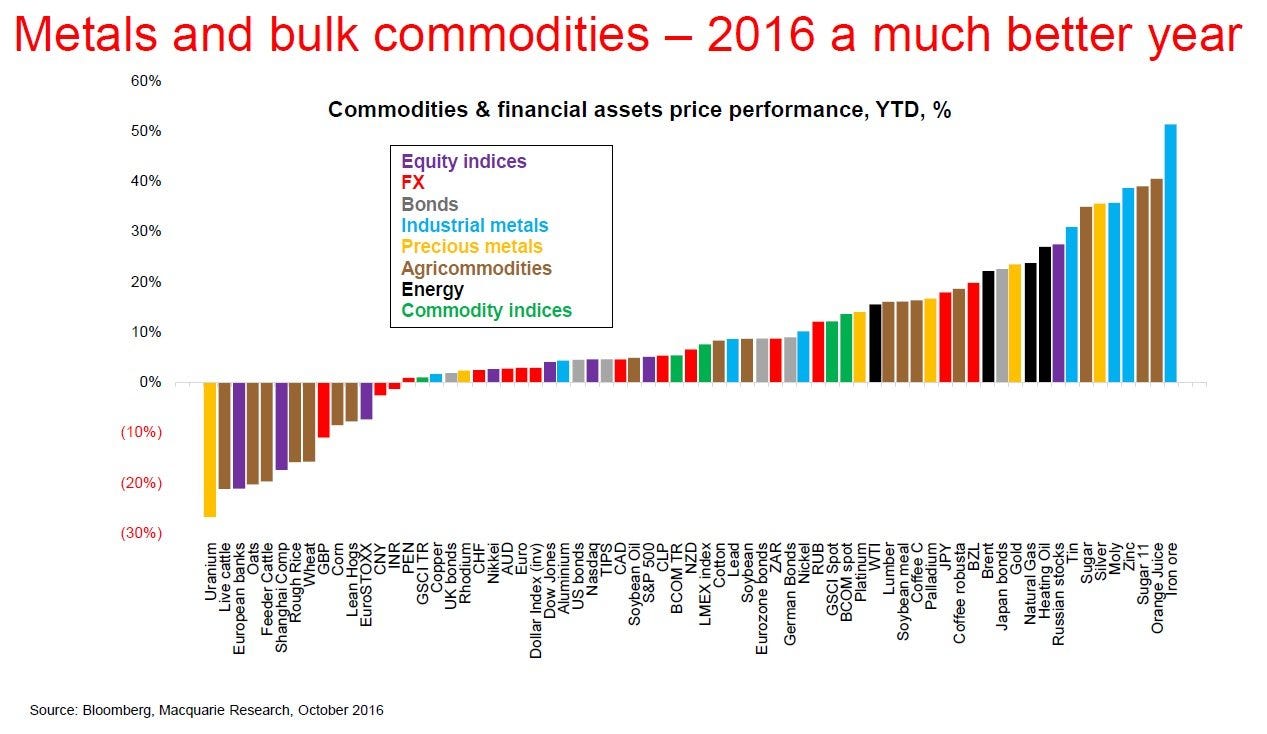

Metals have been having a hey day in 2016. (Business Insider)

Markets

Is your commodity index just an oil index? (Newfound Research)

Move over the $VIX…the Investopedia Anxiety Index is here. (InvestmentNews)

Strategy

Saving more is the new alpha. (Betterment)

Things you really shouldn’t care about. (A Dash of Insight)

The Presidential election market cycle is dead. (FT)

Offers

If you’ve read Thinking Fast and Slow you will likely want to read Michael Lewis’ forthcoming The Undoing Project: A Friendship That Changed Our Minds. (amazon.com)

Try Audible.com and get two free audiobooks including the new memoir byBruce Springsteen, Born to Run. (amazon.com)

Companies

iMessage is a huge competitive advantage for Apple ($AAPL). (Daring Fireball)

Which retailers will be able to capture Millennial shoppers? (Jeff Macke)

If Jeff Bewkes is selling should you be buying? (Justin Fox)

Blackstone Group ($BX) is selling a 25% stake in Hilton Hotels. (WSJ)

Remember the documentary? SeaWorld ($SEAS) certainly does. (Sumzero)

Finance

Private equity is sitting on a load of cash. (AI-CIO)

Being a bank MD is going to get a lot less fun. (eFinancialCareers)

Funds

Eaton Vance ($EV) is getting into the SRI business with the purchase of Calvert. (Institutional Investor)

Where does the Sequioa Fund sit now? (CityWire)

Passive investors are now throwing their weight around. (WSJ)

Earlier on Abnormal Returns

Startup links: pitchforks and torches. (Abnormal Returns)

What you missed in our Monday linkfest. (Abnormal Returns)

Mixed media

The Wirecutter goes under the wing of the New York Times. (Politico)

Why you need your own ‘daily practice.’ (Adam Grimes)